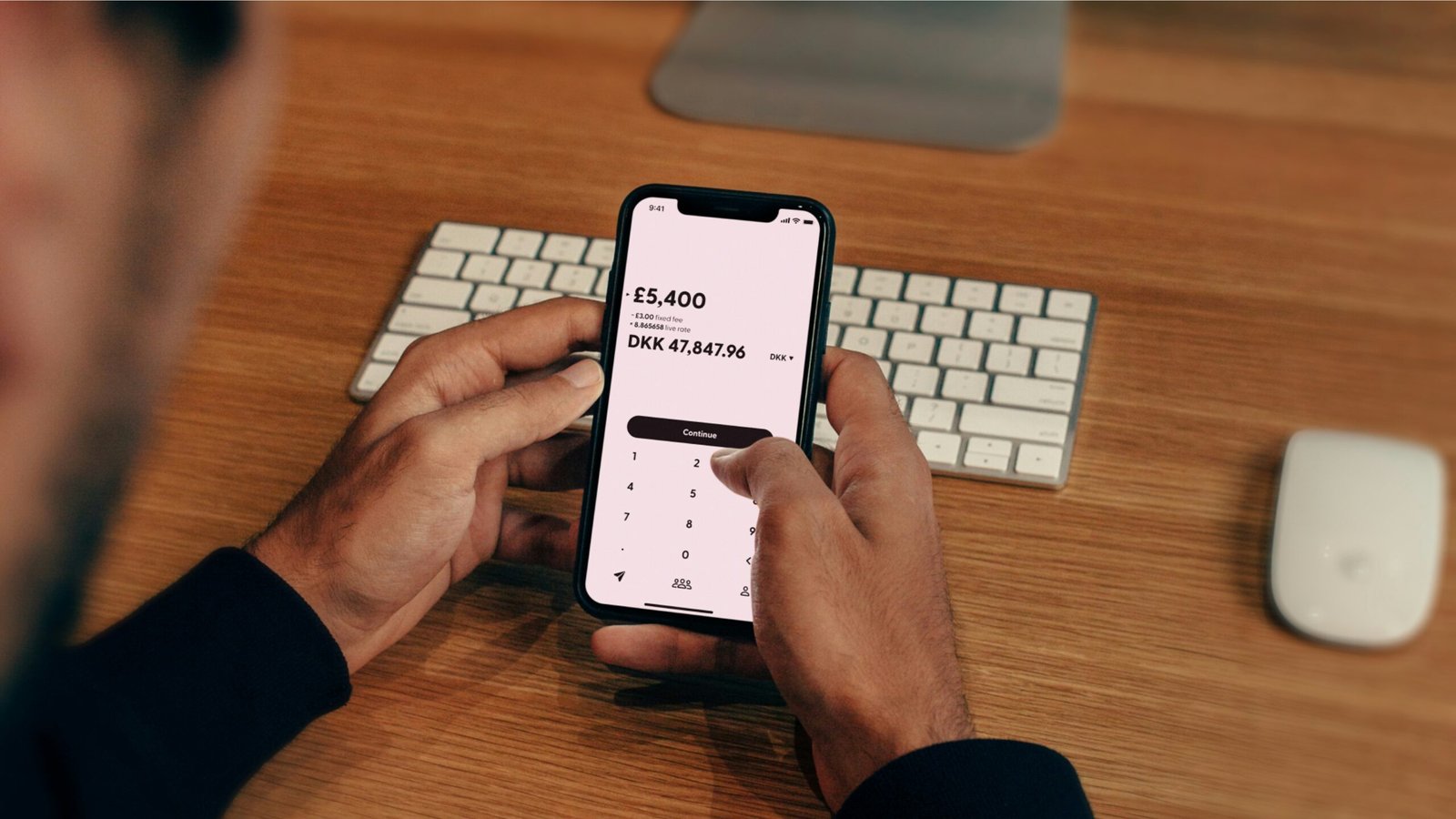

Introduction to Mobile Payments

Mobile payments represent a transformative shift in how consumers and businesses engage in financial transactions. Essentially, mobile payments refer to the use of a smartphone or other mobile device to authorize and complete financial transactions, whether for purchasing goods and services or transferring money between accounts. This technological advancement has fundamentally altered the landscape of financial transactions, moving away from traditional cash and card payments to more efficient, digital means.

The evolution of mobile payments can be traced back to the advent of smartphones and the development of digital wallets and mobile banking apps. Early forms of mobile payments included SMS-based transactions and mobile web payments, which laid the groundwork for the sophisticated apps and NFC (Near Field Communication) technology used today. The shift from traditional payment methods to digital transactions has been driven by several key factors, including the widespread adoption of smartphones, increased internet connectivity, and advancements in security protocols.

One of the primary drivers behind the rise of mobile payments is the demand for convenience and speed. Consumers increasingly prefer the ease of making payments with a few taps on their mobile devices over carrying cash or cards. Businesses, too, benefit from the streamlined transaction processes and reduced operational costs associated with digital payments. Additionally, the growth of e-commerce and the need for contactless payment options, especially highlighted during the COVID-19 pandemic, have further accelerated the adoption of mobile payments.

Current statistics underscore the rapid growth and future potential of mobile payments. According to various industry reports, the global mobile payment market is expected to reach trillions of dollars in value within the next few years. This surge is supported by rising consumer trust in mobile payment platforms and the continuous innovation in fintech solutions. As we explore the future of mobile payments, understanding these foundational aspects sets the stage for examining upcoming innovations and security measures that will shape this dynamic field.

Innovative Technologies Shaping Mobile Payments

The landscape of mobile payments is undergoing a revolution fueled by cutting-edge technologies. One of the cornerstone innovations is Near Field Communication (NFC), a technology that enables contactless payments. NFC allows for secure and instantaneous transactions, making it a preferred option for both consumers and businesses. Its real-world applications can be seen in numerous industries, ranging from retail to public transportation, where speed and convenience are paramount.

Blockchain technology, known for underpinning cryptocurrencies, is another transformative force in mobile payments. Blockchain offers a decentralized and transparent ledger system, which enhances security and reduces the chances of fraud. Its potential extends beyond just cryptocurrency transactions, as evidenced by its adoption in smart contracts and supply chain management, where integrity and traceability are critical.

Biometrics is another pivotal innovation in mobile payments, providing an additional layer of security through unique physiological characteristics like fingerprints, facial recognition, and even voice recognition. By leveraging biometrics, payment systems can offer a seamless yet highly secure user experience, minimizing the risk of unauthorized access. This technology is already being implemented in various applications, from unlocking smartphones to authorizing financial transactions.

QR codes are also playing a significant role in the evolution of mobile payments. Easy to generate and scan, QR codes facilitate swift transactions without the need for physical cards or extensive hardware. This technology is particularly popular in emerging markets, where it provides a cost-effective solution for digital payments. QR codes are now widely used in sectors such as food delivery, retail, and transportation, illustrating their versatility and effectiveness.

Emerging trends like cryptocurrency payments are starting to gain traction as more businesses and consumers recognize the benefits of decentralized digital currencies. Additionally, Artificial Intelligence (AI) is being integrated into mobile payment systems to enhance user experience through personalized recommendations, fraud detection, and customer service automation. AI’s ability to analyze and predict user behavior ensures a more intuitive and secure transaction process.

Overall, these innovative technologies are not just shaping the present but also setting the stage for the future of mobile payments. Their real-world applications and emerging trends illustrate a rapidly evolving ecosystem that promises to offer greater convenience, security, and efficiency for users worldwide.

Security Challenges and Solutions in Mobile Payments

As mobile payments continue to gain traction, ensuring their security becomes paramount. One of the most pressing security challenges is the risk of data breaches. Breaches can expose sensitive information, leading to identity theft and financial fraud. Mobile payment platforms are particularly vulnerable due to the vast amount of personal and financial data they handle.

Fraud is another significant concern in the mobile payment ecosystem. Cybercriminals employ various tactics, such as phishing and malware attacks, to gain unauthorized access to accounts. Additionally, the risk of identity theft remains high as hackers can exploit weak authentication mechanisms to impersonate users and conduct fraudulent transactions.

To address these challenges, several solutions have been developed. Encryption is a foundational security measure, ensuring that data transmitted during a mobile payment transaction remains unreadable to unauthorized parties. Advanced encryption standards (AES) are commonly used to secure data both in transit and at rest.

Tokenization further enhances security by replacing sensitive payment information with unique tokens. These tokens are meaningless to would-be attackers but can be mapped back to the original data by authorized systems, significantly reducing the risk of data theft.

Two-factor authentication (2FA) is another effective measure to combat fraud and identity theft. By requiring users to provide two forms of identification—typically something they know (a password) and something they have (a mobile device)—2FA adds an extra layer of security, making it more difficult for unauthorized users to gain access.

Secure payment gateways also play a crucial role in the security landscape. These gateways act as intermediaries, facilitating secure transactions between the user and the merchant. They often include features such as fraud detection algorithms and compliance with industry standards like PCI DSS (Payment Card Industry Data Security Standard).

Real-world examples illustrate the importance of these security measures. For instance, the 2014 data breach of a major retail chain exposed millions of credit card details. In response, the company implemented robust encryption and tokenization solutions, along with enhanced fraud detection mechanisms, significantly improving their security posture.

By adopting these advanced security measures, stakeholders in the mobile payment industry can better protect their users’ data, ensuring a safer and more trustworthy environment for digital transactions.

The Future Outlook for Mobile Payments

The future of mobile payments is poised for significant advancements, driven by emerging technologies and evolving consumer expectations. One of the most promising developments is the increasing adoption of 5G technology, which promises to transform the mobile payments landscape. With faster data speeds and reduced latency, 5G will enable more seamless and secure transactions, facilitating real-time payments and enhancing the overall user experience.

Another trend shaping the future of mobile payments is the integration with other digital services. As the digital ecosystem becomes more interconnected, mobile payment solutions are likely to be embedded in a wide range of applications, from banking and retail to social media and transportation. This integration will provide consumers with a more cohesive and convenient experience, allowing them to manage their finances, make purchases, and access services through a single platform.

Regulatory changes will also play a crucial role in the evolution of mobile payments. Governments and regulatory bodies are continually updating policies to address security concerns and ensure consumer protection. The implementation of stronger data privacy laws and standards, such as the General Data Protection Regulation (GDPR) in Europe, will necessitate enhanced security measures and foster greater trust in mobile payment systems. Additionally, regulatory support for digital currencies and blockchain technology could further revolutionize the industry by providing more efficient and transparent payment solutions.

Market forecasts and expert predictions indicate that the global mobile payments market will continue to grow at a rapid pace. According to a report by Statista, the total transaction value in the mobile payments segment is expected to reach $14 trillion by 2026. Industry leaders, such as PayPal and Apple Pay, are investing heavily in innovation to stay ahead of the curve, focusing on enhancing security, expanding their service offerings, and exploring new markets.

To prepare for these changes, businesses should invest in the latest mobile payment technologies and prioritize cybersecurity to protect consumer data. Consumers, on the other hand, should stay informed about new payment options and adopt secure practices to safeguard their financial information. By embracing these advancements, both businesses and consumers can capitalize on the opportunities presented by the evolving mobile payments landscape.