Understanding Omnichannel Payments

Omnichannel payments refer to a comprehensive approach to payment processing that integrates multiple payment methods across various channels to provide customers with a seamless transaction experience. This includes traditional payment methods, such as credit and debit cards, as well as modern solutions like digital wallets and mobile payment applications. The convergence of these payment methods allows consumers to engage with businesses in a manner most convenient for them, whether shopping online, in-store, or through a mobile app.

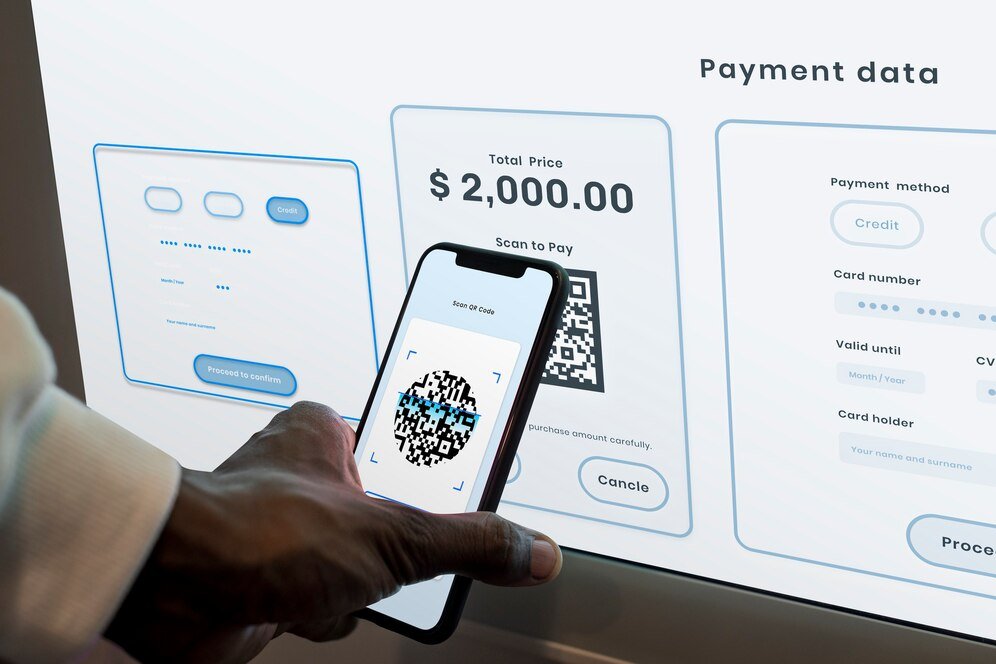

The technological infrastructure supporting omnichannel payments is crucial for effective implementation. Systems that enable this approach include robust payment processing platforms that facilitate real-time transactions and data synchronization between channels. Digital wallets like Apple Pay or Google Pay exemplify how technology can streamline the payment process, offering users the ability to make purchases securely with just a tap of their smartphones. Mobile payments are also gaining traction, with increasing smartphone penetration and the rising use of contactless payment options. These innovations play an essential role in enhancing consumer convenience and driving sales.

Moreover, the significance of a unified payment strategy cannot be overstated for businesses looking to enhance customer experiences. By integrating various payment methods, companies can cater to diverse consumer preferences and increase transaction efficiency. For instance, a customer might prefer making an online purchase using a digital wallet but favors in-store transactions with a credit card. The ability to offer both options under a unified system fosters customer loyalty and improves satisfaction. Additionally, businesses benefit from streamlined operations and data analytics that provide insights into purchasing behavior across channels. Therefore, understanding and implementing omnichannel payments is vital for companies aiming to succeed in today’s competitive market landscape.

The Benefits of Omnichannel Payment Systems

Omnichannel payment systems have emerged as a transformative force in the realm of financial transactions, benefiting both businesses and consumers alike. One of the most significant advantages of these systems is the enhanced customer satisfaction they provide. By offering multiple payment options across various channels—such as in-store, online, and mobile—these systems cater to the diverse preferences of consumers. This flexibility allows customers to choose the payment method that best suits their needs, ensuring a smoother and more convenient shopping experience.

Moreover, omnichannel payment systems can lead to higher sales conversion rates. When customers encounter multiple payment options that are seamlessly integrated, they are less likely to abandon their shopping carts due to frustration with limited payment methods. This increased accessibility can significantly boost revenue for businesses, as customers are more inclined to complete purchases when they feel their preferred payment method is available.

Another critical benefit of omnichannel payments is the capacity for improved data analytics. By integrating payment solutions across various channels, businesses can gather comprehensive data on customer preferences and purchasing behavior. This valuable insight allows companies to tailor their marketing strategies, optimize inventory management, and enhance overall customer service. The ability to analyze consumer data effectively is pivotal in today’s competitive market, empowering businesses to make informed decisions that foster growth.

Finally, facilitating a consistent and customer-friendly payment experience enhances brand loyalty. When consumers have positive experiences associated with their transactions, they are more likely to return and recommend the business to others. Omnichannel payment systems help brands establish trust and reliability, creating lasting relationships with customers. As businesses evolve, the integration of such systems will prove essential in meeting the dynamic demands of modern consumers, ultimately driving long-term success.

Challenges in Implementing Omnichannel Payments

Implementing an omnichannel payment system presents various challenges for businesses striving to create seamless, customer-centric transaction experiences. One of the primary hurdles is technical difficulties associated with integrating diverse payment platforms and channels. Businesses must ensure that their existing infrastructure can communicate efficiently with various point-of-sale systems, mobile applications, and online payment portals. This requires both significant investment and a comprehensive understanding of IT systems, creating a barrier for smaller enterprises or those lacking technological expertise.

Data security further complicates the implementation of omnichannel payment systems. As organizations adopt multiple payment channels, the risk of data breaches and cyberattacks increases. Ensuring the security of sensitive customer information—notably payment details—is paramount. Businesses must deploy advanced encryption technologies and secure payment gateways to protect data across all touchpoints. It is essential to stay updated with the latest cybersecurity trends and invest in employee training to mitigate vulnerabilities.

Managing customer trust is also critical during the transition to an omnichannel payment structure. Customers expect transparency and reliability when making transactions. Any service disruption, security failure, or perceived complexity may result in lost sales and damaged reputations. Therefore, it is vital to maintain open communication with customers, informing them of changes, and assuring them of the security measures in place to protect their information.

Furthermore, adherence to regulatory compliance is a notable challenge. With numerous laws governing payment processing and data protection, businesses must navigate these complex guidelines to avoid penalties. Establishing a robust compliance framework is necessary, which may include regular audits and updates to systems as regulations evolve. By implementing best practices and leveraging technology, organizations can overcome these challenges, paving the way for successful omnichannel payment implementation.

Future Trends in Omnichannel Payments

The landscape of omnichannel payments is rapidly evolving, influenced by consumer preferences, technological advancements, and economic shifts. To maintain competitiveness, businesses must stay attuned to these trends as they reshape the transactional sphere. One significant trend is the integration of artificial intelligence (AI) and machine learning into payment systems. These technologies enhance fraud detection capabilities by analyzing transaction patterns in real-time, allowing for immediate identification and mitigations of suspicious activities. As AI continues to advance, businesses can expect more sophisticated tools that will not only improve security but also streamline the payment process.

Another emerging trend is the rise of cryptocurrency acceptance in various retail environments, as well as e-commerce platforms. With heightened consumer interest in digital currencies such as Bitcoin and Ethereum, businesses are increasingly inclined to incorporate these payment methods to meet customer demands. This acceptance marks a shift in the traditional payment ecosystem and signals potential long-term changes in how transactions are conducted. As more consumers turn to cryptocurrencies, businesses must assess how they can integrate these options seamlessly while still ensuring regulatory compliance.

Additionally, the growth of social commerce is reshaping the way consumers shop and make payments. Platforms like Instagram and Facebook are optimizing their interfaces to support direct purchases, encouraging brands to leverage social media as not just marketing tools but also as viable sales channels. This trend underscores the importance for businesses to create a cohesive omnichannel experience that blends online, mobile, and physical touchpoints, catering to the evolving shopping behaviors of consumers.

As consumer expectations evolve, businesses must adopt agile strategies to respond to these changes effectively. The importance of understanding and implementing these future trends cannot be overstated, as they represent the next stage of transaction evolution in a competitive marketplace.