Introduction to Peer-to-Peer Lending

Peer-to-peer (P2P) lending is an innovative financial arrangement that connects borrowers directly with lenders through online platforms, effectively bypassing traditional banking institutions. By leveraging digital technology, P2P lending platforms facilitate loans without the need for intermediary banks, offering a streamlined and often more efficient process for both parties involved. This system marks a significant shift in the financial landscape, addressing the growing demand for alternative lending solutions.

The basic mechanics of P2P lending involve three key players: borrowers, investors, and platform providers. Borrowers, typically individuals or small businesses, seek funds for various purposes such as debt consolidation, home improvement, or business expansion. Investors, on the other hand, are individuals or institutions looking to earn returns on their capital by lending it to creditworthy borrowers. The online platforms act as intermediaries, handling the vetting of borrowers, processing loans, and facilitating repayments. These platforms employ sophisticated algorithms and credit assessment tools to evaluate the risk associated with each loan, ensuring a fair and transparent system for all participants.

Historically, P2P lending emerged as a response to the limitations of traditional banking systems, which often involve rigorous application processes, lengthy approval times, and restrictive loan criteria. The concept gained traction in the mid-2000s, driven by advances in internet technology and a growing disillusionment with conventional banking practices, especially in the wake of the 2008 financial crisis. The crisis highlighted the vulnerabilities of traditional banks, prompting consumers and businesses to seek more resilient and accessible financial alternatives.

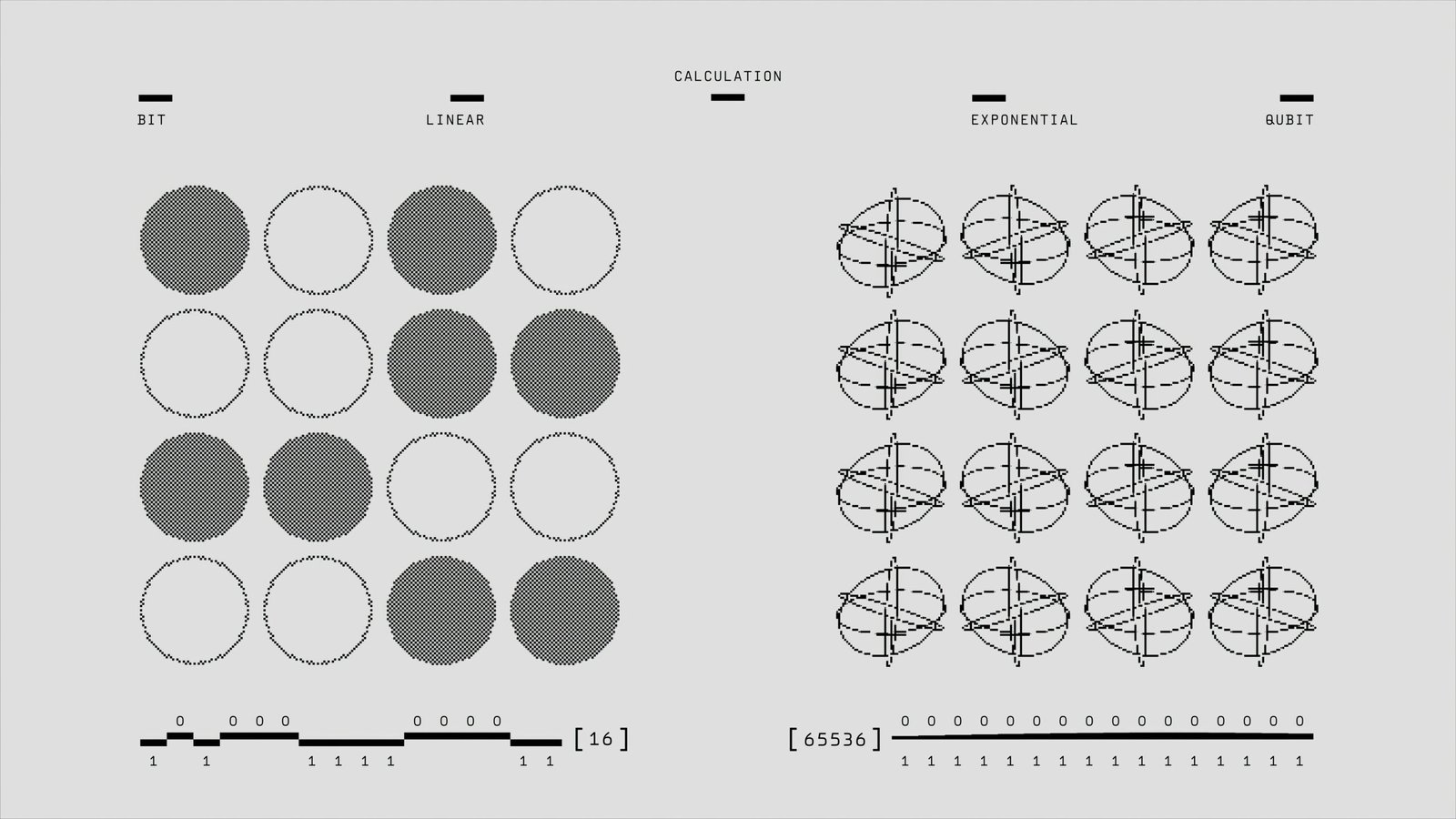

As a result, the P2P lending industry has witnessed exponential growth, with platforms proliferating globally and attracting a diverse range of participants. This model not only democratizes access to credit but also offers investors higher returns compared to traditional savings accounts or bonds. By fostering a direct connection between borrowers and lenders, P2P lending continues to disrupt the traditional banking paradigm, paving the way for a more inclusive and dynamic financial ecosystem.

Advantages and Benefits of Peer-to-Peer Lending

Peer-to-peer (P2P) lending has emerged as a formidable alternative to traditional banking, offering distinct advantages for both borrowers and investors. For borrowers, one of the primary benefits is the potential for lower interest rates. Traditional banks often have higher overhead costs, which can translate into higher loan rates. In contrast, P2P platforms operate with lower costs and can pass these savings on to borrowers. A study by LendingClub revealed that borrowers could save an average of 5% on interest rates compared to traditional bank loans.

Another significant advantage for borrowers is the expedited approval process. Traditional banks may take weeks or even months to approve a loan, often bogged down by extensive paperwork and bureaucratic procedures. P2P platforms streamline this process using advanced algorithms and technology, allowing for quicker decisions. For instance, Prosper reports that many of their borrowers receive approval in as little as three business days. This speed is a crucial advantage for individuals needing quick access to funds for emergencies or time-sensitive investments.

Furthermore, P2P lending offers more flexible lending criteria compared to traditional banks. Traditional financial institutions usually have stringent requirements, focusing heavily on credit scores and financial history. P2P platforms, on the other hand, often consider a broader range of factors, making it easier for individuals with less-than-perfect credit scores to secure loans. This inclusivity expands financial access, particularly for underserved communities.

For investors, P2P lending presents an attractive opportunity for higher returns. Conventional investment channels like savings accounts and certificates of deposit (CDs) offer relatively low returns, typically below 2%. In contrast, P2P lending can offer returns of 5% to 7% or higher, depending on the loan’s risk profile. A report from P2P Market Data shows that some platforms have provided average annual returns exceeding 7% over the past five years.

Diversification is another key benefit for investors. P2P lending allows investors to spread their capital across multiple loans, reducing the risk associated with any single loan default. This diversification is further enhanced by the ability to invest in loans across different sectors and geographic regions. Additionally, investors have the unique advantage of directly choosing the specific loans they wish to fund, offering a level of control and personalization not typically available in traditional investment avenues.

Overall, the advantages and benefits of P2P lending make it an appealing option for both borrowers and investors, providing a flexible, efficient, and potentially more profitable alternative to traditional banking systems.

Challenges and Risks Associated with Peer-to-Peer Lending

Peer-to-peer (P2P) lending has revolutionized the financial landscape by providing an alternative to traditional banking. However, this innovation is not without its challenges and risks. One of the primary concerns is regulatory inconsistency, as the regulatory landscape for P2P lending varies significantly across regions. Some countries have stringent regulations in place, while others have a more laissez-faire approach. This disparity can create an uneven playing field and increase the risk for both lenders and borrowers.

Credit risk is another significant challenge in P2P lending. Unlike traditional banks that have robust mechanisms for assessing creditworthiness, P2P platforms often rely on less comprehensive evaluation processes. This can lead to higher default rates, posing a considerable risk to investors. Additionally, the lack of deposit insurance in P2P lending means that investors do not have the same safety nets that exist in traditional banking. If a borrower defaults, the investor bears the full brunt of the loss.

Platform risk is also a critical concern. The viability of P2P lending platforms is not guaranteed, and several have failed in the past, leading to substantial losses for investors. For example, in 2016, the collapse of the UK-based platform, TrustBuddy, left many investors unable to recover their funds. Such incidents highlight the importance of conducting thorough due diligence before committing capital to a P2P platform.

To mitigate these risks, both platforms and investors need to adopt robust risk management strategies. Platforms should implement stringent credit assessment processes and maintain transparent operations to foster trust. Investors, on the other hand, should diversify their investment portfolios to spread risk and avoid putting all their funds into a single platform or loan.

In summary, while P2P lending offers exciting opportunities, it also comes with significant risks. Understanding these challenges and taking proactive steps to manage them is crucial for anyone looking to engage in peer-to-peer lending.

The Future of Peer-to-Peer Lending and Its Impact on Traditional Banking

Peer-to-peer (P2P) lending has emerged as a formidable alternative to traditional banking, promising significant transformations in the financial ecosystem. Foremost among the current trends within the P2P sector is the seamless integration of artificial intelligence (AI) and blockchain technology. AI facilitates more accurate risk assessment and personalized loan offerings, while blockchain ensures transparent and secure transactions. These technological advancements are not only enhancing the efficiency of P2P platforms but are also setting new standards in the financial services industry.

Looking ahead, the P2P lending landscape is expected to evolve through increased collaboration with traditional banks. Financial institutions are recognizing the potential of P2P platforms to complement their services. By partnering with or investing in P2P companies, banks can access new customer segments and offer more competitive rates. This symbiotic relationship could lead to a more integrated financial ecosystem where traditional banks leverage P2P lending’s agility and innovation.

However, the possibility of further disruption remains strong. As P2P lending continues to gain traction, traditional banks may face intensified competition. The streamlined, user-centric approach of P2P platforms appeals to a tech-savvy generation that values convenience and transparency. This shift in consumer preference could prompt banks to overhaul their business models, focusing more on enhancing customer experience and adopting cutting-edge technologies.

Expert opinions and market forecasts suggest a dynamic future for P2P lending. According to recent reports, the global P2P lending market could witness exponential growth in the coming years, driven by rising digital adoption and increasing demand for alternative financing solutions. Analysts predict that as regulatory frameworks become more robust, investor confidence in P2P lending will strengthen, further propelling its ascent.

In conclusion, the future of P2P lending holds promising prospects, with the potential to either collaborate with or disrupt traditional banking. The fusion of advanced technologies, evolving consumer expectations, and strategic partnerships will shape the trajectory of this burgeoning sector. As the financial landscape continues to transform, both P2P platforms and traditional banks must navigate these changes to thrive in a competitive market.