Introduction to Regulatory Frameworks

The fintech industry operates within a complex web of regulatory frameworks that vary significantly across different regions. Key regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC) in the US, and the European Banking Authority (EBA), play pivotal roles in shaping the operational landscape for fintech companies. These frameworks are designed to ensure financial stability, protect consumers, and prevent fraudulent activities.

The Financial Conduct Authority (FCA) in the UK focuses on ensuring that financial markets operate with integrity and transparency. It mandates rigorous standards for fintech companies to prevent misconduct and protect consumer interests. Across the Atlantic, the Securities and Exchange Commission (SEC) in the US enforces regulations that govern securities transactions, aiming to safeguard investor interests and maintain fair market practices. Meanwhile, the European Banking Authority (EBA) oversees the banking sector within the European Union, ensuring robust prudential regulation and supervision.

The importance of these regulatory frameworks cannot be overstated. They serve as the backbone of the financial ecosystem, fostering trust and stability. By setting stringent compliance requirements, these bodies help mitigate risks associated with financial transactions and protect consumers from potential malpractices. Furthermore, these regulations promote transparency, enabling consumers and investors to make informed decisions based on accurate and reliable information.

However, regulatory approaches can vary significantly between regions, presenting unique challenges for fintech businesses operating on a global scale. For instance, the US regulatory environment is characterized by a fragmented approach with multiple federal and state-level agencies, each with its own set of requirements. In contrast, the European Union adopts a more harmonized framework through directives and regulations that apply uniformly across member states. These regional differences necessitate that fintech companies develop robust compliance strategies tailored to the specific regulatory environments in which they operate.

Navigating the intricate regulatory landscape is crucial for fintech companies to achieve sustainable growth and build consumer trust. By understanding and adhering to the diverse regulatory frameworks, these businesses can not only avoid legal pitfalls but also position themselves as reliable and trustworthy players in the financial industry.

Compliance Challenges for Fintech Companies

The fintech industry, characterized by its rapid innovation and disruptive potential, faces a labyrinth of regulatory requirements. Among the most significant challenges are adhering to anti-money laundering (AML) and know your customer (KYC) regulations. These mandates require fintech companies to implement stringent customer identification processes and continuously monitor transactions to detect and prevent illicit activities. Despite their necessity, the complexity and cost of compliance can be daunting for startups and smaller enterprises.

Another critical area is data protection, with regulations like the General Data Protection Regulation (GDPR) setting high standards for data privacy. Compliance demands robust data handling practices, including securing user consent for data collection, ensuring data accuracy, and implementing stringent measures to protect against breaches. Non-compliance with GDPR can result in substantial fines, which underscores the importance of rigorous data protection protocols.

Cybersecurity regulations also loom large. As fintech companies handle sensitive financial data, they become prime targets for cyber-attacks. Regulations often require the implementation of comprehensive cybersecurity frameworks to safeguard against threats. This includes regular security assessments, incident response plans, and encryption of data. Balancing innovation with these stringent security requirements poses a continuing challenge for the industry.

Examples of common compliance issues include inadequate customer verification processes, insufficient data protection measures, and failure to report suspicious activities promptly. These lapses can attract severe penalties, ranging from hefty fines to operational restrictions, and can significantly damage a company’s reputation.

To navigate these regulatory challenges, fintech companies can leverage several strategies. Hiring dedicated compliance officers who are well-versed in current regulations ensures that internal practices align with legal requirements. Additionally, adopting regulatory technology (regtech) solutions can automate compliance processes, reducing the risk of human error and improving efficiency. Regtech tools can assist in real-time transaction monitoring, regulatory reporting, and risk management, thereby easing the burden of compliance.

In conclusion, while regulatory compliance presents significant challenges for fintech companies, a proactive approach incorporating specialized personnel and advanced technology can mitigate these risks, ensuring continued innovation and growth within the industry.

Impact of Evolving Regulations

In the continually evolving fintech landscape, regulatory changes significantly shape the industry. Recent developments have been particularly noteworthy, with new regulations aiming to foster innovation while ensuring consumer protection. One such transformative regulatory change is the introduction of open banking regulations. Open banking mandates that banks share customer data with third-party providers upon the customer’s consent, thus encouraging competition and innovation. Fintech companies benefit from this openness by gaining access to valuable data, which they can leverage to offer personalized services and enhance user experience.

Another critical area of evolving regulatory focus is cryptocurrency. Governments and regulatory bodies worldwide are increasingly scrutinizing cryptocurrency activities to mitigate risks associated with money laundering, fraud, and market manipulation. Recent changes include stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, which, while imposing additional compliance burdens on fintech firms, also create a safer and more trustworthy environment for consumers and investors.

Consumer protection laws are also evolving, with heightened focus on data privacy and security. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States set new standards for how companies must handle personal data. These regulations compel fintech companies to implement robust data protection measures, which can be resource-intensive but ultimately build consumer trust and loyalty.

Despite the challenges presented by these evolving regulations, they also offer opportunities for fintech companies to differentiate themselves through compliance excellence and innovation. Staying agile and adaptable in response to regulatory changes is crucial. Fintech firms must continuously monitor regulatory landscapes, invest in compliance infrastructure, and engage with regulators proactively. By doing so, they can not only mitigate risks but also capitalize on new opportunities that arise from a well-regulated and trusted financial ecosystem.

Strategies for Effective Regulatory Navigation

To successfully navigate the complex regulatory landscape, fintech companies must adopt strategic approaches that encompass various essential elements. Building robust relationships with regulators is paramount. Open lines of communication can foster mutual understanding and trust, enabling fintech firms to gain insights into regulatory expectations and provide feedback on proposed regulations. Regular, proactive engagement with regulatory bodies can help companies stay ahead of compliance requirements and avoid potential pitfalls.

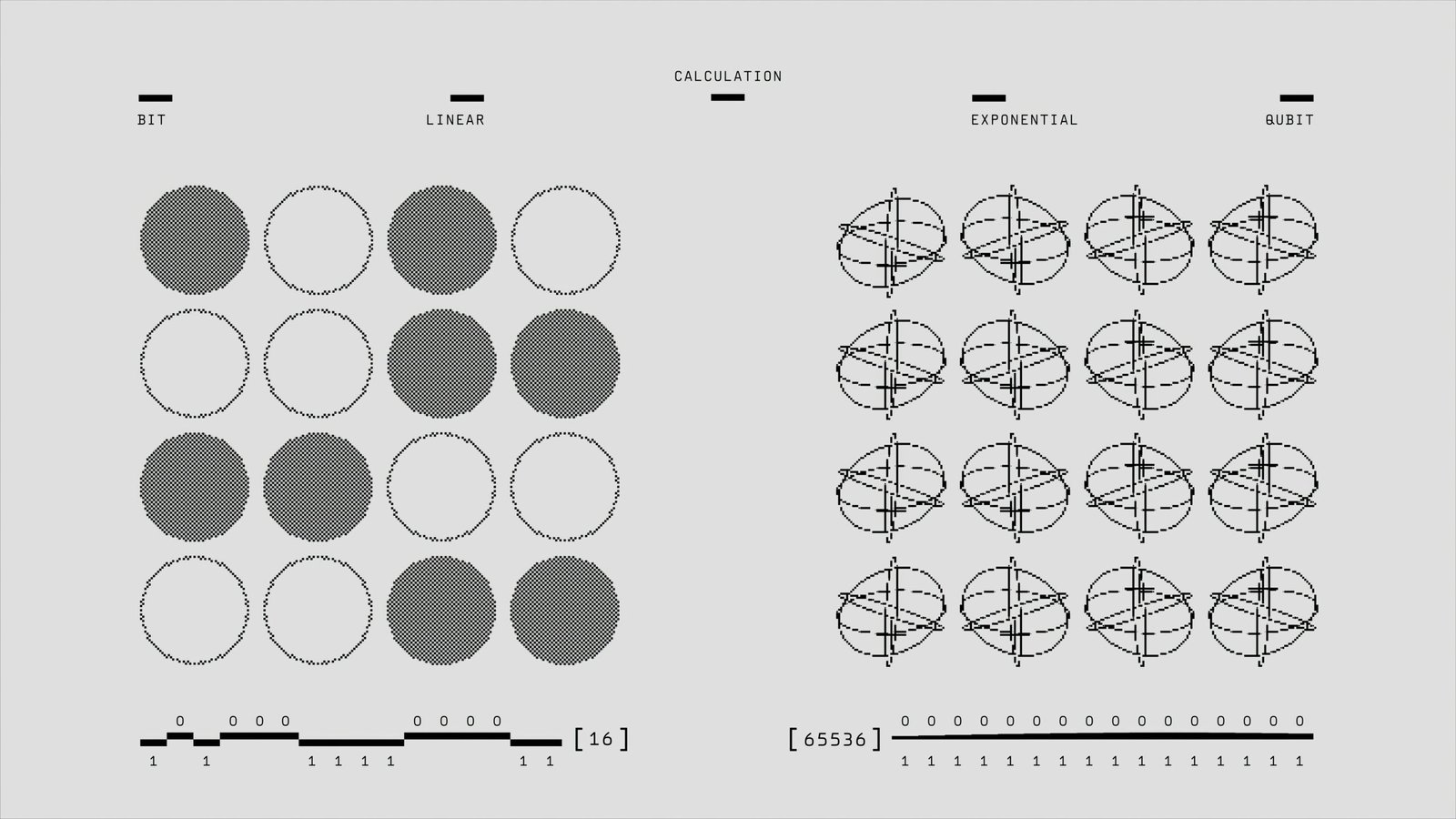

Investing in compliance technology is another critical strategy. Advanced technologies, such as artificial intelligence and machine learning, can streamline compliance processes, improve accuracy, and reduce operational costs. These tools can automate the monitoring of transactions, flag suspicious activities, and ensure that compliance measures are consistently applied across the organization. By leveraging these technologies, fintech companies can enhance their ability to meet regulatory standards efficiently.

Fostering a culture of compliance within the organization is equally vital. This involves integrating compliance into the company’s core values and ensuring that all employees understand its importance. Regular training programs, clear policies, and a strong tone from the top can reinforce the significance of compliance. When employees are well-informed and committed to regulatory adherence, the organization as a whole is better positioned to navigate regulatory challenges effectively.

Staying informed about regulatory changes is crucial for fintech companies. The regulatory environment is dynamic, and staying updated on new laws and amendments can prevent companies from falling out of compliance. Subscribing to regulatory updates, attending industry seminars, and participating in relevant forums can help companies maintain a keen awareness of the evolving landscape.

Engaging in industry collaborations and advocacy efforts can also provide significant advantages. By participating in industry associations and working groups, fintech companies can influence regulatory developments and contribute to shaping a favorable regulatory environment. Collaboration with peers can lead to shared best practices and collective problem-solving, benefiting the entire industry.

Looking ahead, the future of fintech regulation is likely to be characterized by continuous evolution. Companies should prepare for this by developing adaptable compliance frameworks that can accommodate new regulations as they emerge. Staying agile and proactive in their compliance efforts will enable fintech firms to navigate the regulatory landscape successfully and continue to innovate in the fast-paced world of financial technology.