Introduction to Mobile Banking

Mobile banking represents a transformative shift in the financial services landscape, leveraging evolving digital technologies to offer banking services via smartphones and other mobile devices. This innovation allows customers to conduct various transactions, such as checking account balances, transferring funds, paying bills, and even investing, all from the convenience of their handheld devices.

The history of mobile banking can be traced back to the simple SMS alerts used by banks in the early 2000s, notifying customers of account activities. As mobile technology advanced, the development of mobile applications enabled a more interactive and comprehensive banking experience. The evolution from traditional brick-and-mortar banks to digital platforms and mobile apps has redefined how customers interact with their financial institutions.

Mobile banking’s significance in today’s financial ecosystem cannot be overstated. It provides unparalleled convenience, enabling users to manage their finances on-the-go, without the need to visit a physical branch. This has led to enhanced customer engagement and satisfaction, as well as operational efficiency for banks. Moreover, the advent of mobile banking has broadened financial inclusion, granting access to banking services for individuals in remote and underserved areas.

In essence, mobile banking has revolutionized customer interactions, offering a seamless, efficient, and more personalized banking experience. By harnessing the power of digital technology, financial institutions have not only met but exceeded customer expectations, paving the way for a more accessible and instant financial solution. This ongoing development underscores the dynamic nature of the banking industry and its continuous adaptation to the evolving digital landscape.

Key Features of Mobile Banking

Modern mobile banking apps are designed to offer a comprehensive suite of features that cater to various financial needs, significantly enhancing customer experience. At the core of these applications is account management, which allows users to view their account balances, transaction history, and recent activities in real-time. This transparent visibility into finances empowers users with better control over their monetary transactions.

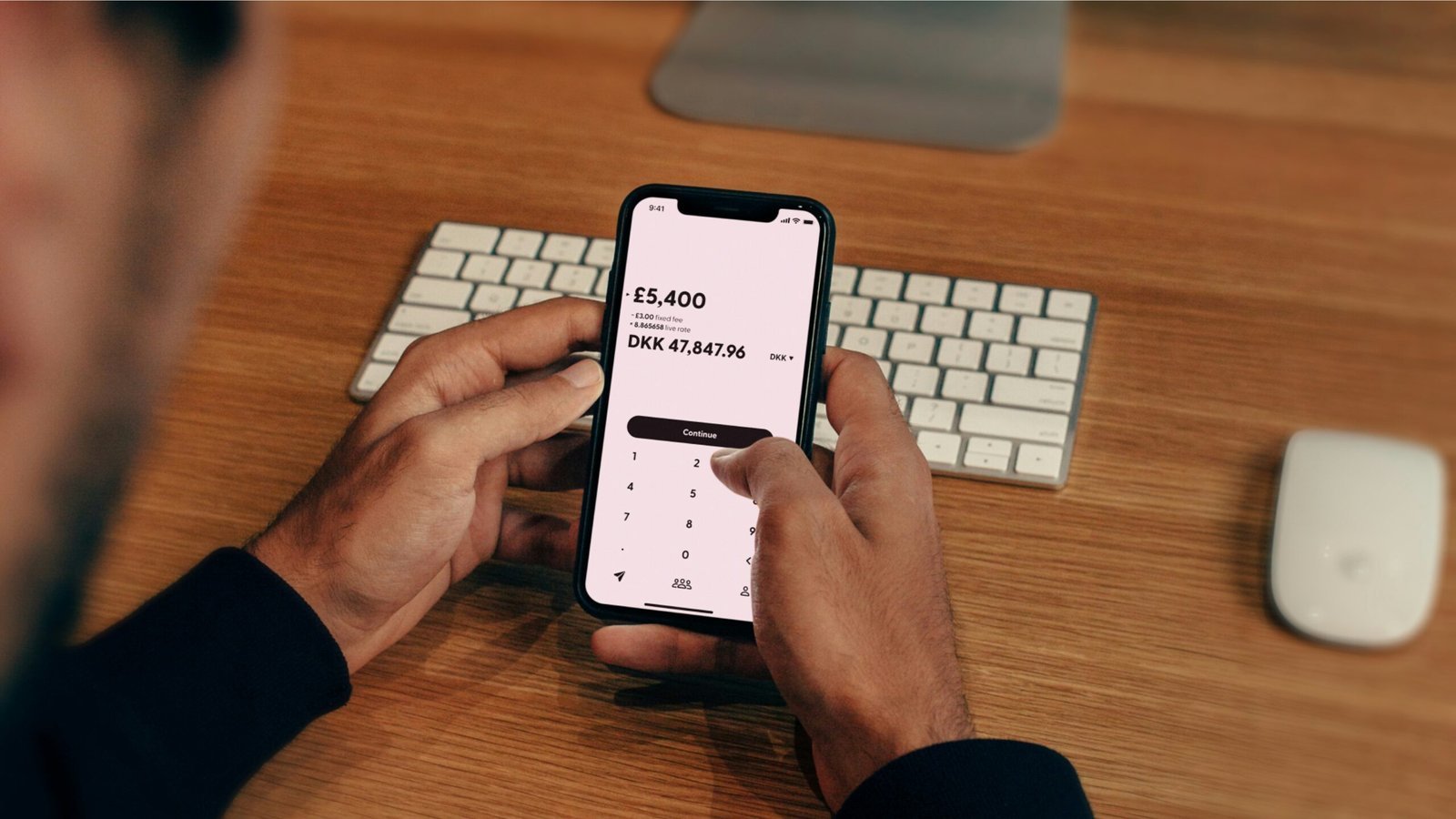

Another pivotal functionality of mobile banking is the ability to conduct fund transfers. Users can effortlessly transfer money between their own accounts or to other accounts, whether within the same bank or across different banks. This service often includes features such as setting up recurring transfers and scheduling future transactions, providing user flexibility and convenience.

Bill payments constitute another essential service offered by mobile banking apps. Customers can link their utilities, credit card accounts, and other billers, enabling automatic or manual payments. This functionality not only simplifies the process of settling bills but also helps to avoid late payment penalties through reminders and scheduled payments. The convenience of paying bills on-the-go is a notable enhancement to traditional banking methods.

Mobile check deposits have become increasingly popular, eliminating the need for physical bank visits. Users can deposit checks by simply taking a photo of the check via their smartphone. This feature not only saves valuable time but also accelerates the check-clearing process, making funds available sooner.

Budgeting tools offered by mobile banking apps are instrumental in financial planning. These tools typically allow users to categorize expenses, set budgetary goals, and track spending patterns. Detailed analytics provided within these tools help customers make informed financial decisions, fostering better money management habits.

Overall, these features in mobile banking apps are meticulously designed to meet evolving customer needs, providing convenience, security, and detailed financial insights. As a result, they not only elevate the user experience but also build customer trust and satisfaction with their banking institution.

Benefits of Mobile Banking for Customers

Mobile banking brings a variety of advantages to customers, starting with the convenience of 24/7 account access. Unlike traditional banking, limited by operating hours, mobile banking apps allow users to check balances, transfer funds, and manage accounts at any time. This round-the-clock accessibility significantly enhances customer satisfaction by providing the freedom to bank according to one’s schedule.

The ability to perform remote transactions stands out as another major benefit. Users can complete various banking activities from the comfort of their homes or while on the go, eliminating the need to visit a physical branch. This not only saves valuable time but also offers greater flexibility, enabling quick responses to financial needs and responsibilities.

Security concerns, a common apprehension for many, are assuaged by the sophisticated measures embedded within mobile banking systems. Features such as biometric authentication, including fingerprint and facial recognition, add an extra layer of security. These advanced methods mitigate the risk of unauthorized access, thereby ensuring that customer accounts and personal details remain protected.

Moreover, mobile banking plays a crucial role in promoting financial inclusion. By extending banking services to underserved communities, it bridges the gap between the unbanked and financial institutions. Many individuals who previously lacked access to traditional banking services can now effortlessly participate in the financial system through their mobile devices. This inclusion lays the groundwork for broader economic growth and personal financial empowerment.

Overall, the benefits of mobile banking for customers are manifold, including accessible banking, time-saving transactions, enhanced security, and increased financial inclusion. As technology continues to advance, the features and advantages of mobile banking will likely expand further, providing even greater value to customers worldwide.

Future Trends in Mobile Banking

The mobile banking sector is on the cusp of transformative advancements, driven by innovative technologies like artificial intelligence (AI), blockchain, and 5G. These technologies promise to significantly uplift customer experience by making banking services more seamless, efficient, and secure.

AI is poised to revolutionize mobile banking through enhanced data analytics, personalized customer interactions, and advanced security measures. Machine learning models can analyze vast amounts of transactional data in real-time to offer customized financial advice and detect fraudulent activities more effectively. Chatbots powered by AI can handle customer inquiries round the clock, providing instant and accurate responses, thus vastly improving customer service.

Blockchain technology, known for its capability to provide secure and transparent transactions, is also expected to make a profound impact. By decentralizing transaction records, blockchain can drastically reduce the risk of fraud and enhance the security of mobile banking services. Moreover, it facilitates faster processing of cross-border payments and smart contracts, which can lead to more streamlined and trustworthy financial processes.

The introduction of 5G technology is another game-changer for mobile banking. With its high-speed connectivity and low latency, 5G is set to enrich mobile banking applications, allowing for smoother and faster user experiences. This is particularly beneficial for services like mobile payments, video banking, and real-time financial transactions. Additionally, 5G’s capacity to support the Internet of Things (IoT) will enable banks to offer more innovative services, such as smart ATMs and connected devices for enhanced customer engagement.

Collectively, these technological advancements are not only poised to elevate the standard of mobile banking services but also to redefine customer expectations. As banks continue to integrate AI, blockchain, and 5G into their operations, customers can anticipate more personalized, secure, and swift banking experiences, heralding a new era in the financial sector.