Introduction to Insurtech

Insurtech, a portmanteau of ‘insurance’ and ‘technology,’ represents the advent of technological innovation within the insurance industry. It has emerged as a response to the traditional challenges faced by insurers, aiming to enhance efficiency, reduce costs, and improve customer satisfaction. Historically, the insurance sector has been characterized by labor-intensive processes, complex policy management, and slow claim resolutions. These challenges often result in high operational costs and suboptimal customer experiences.

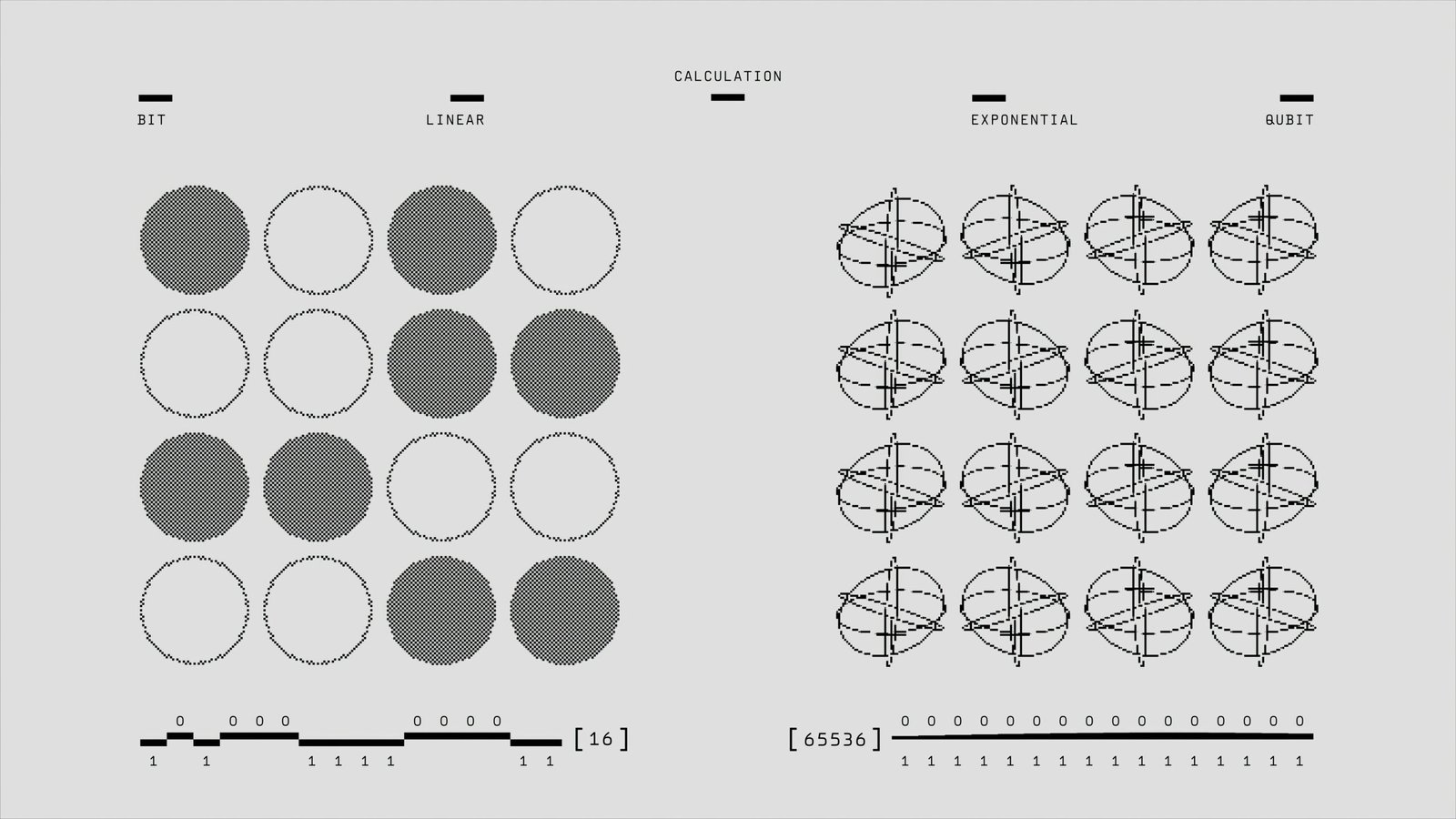

The integration of advanced technologies such as artificial intelligence (AI), machine learning, blockchain, and the Internet of Things (IoT) offers promising solutions to these long-standing issues. AI and machine learning, for instance, enable insurers to analyze vast amounts of data for more accurate risk assessment and personalized policy offerings. Blockchain technology ensures transparency and security in transactions, reducing the risk of fraud and speeding up claims processing. Meanwhile, IoT devices, including wearable health trackers and smart home sensors, provide real-time data that can be used to tailor insurance products and premiums to individual needs.

In essence, insurtech is transforming the insurance landscape by leveraging these key technologies to foster innovation. The ability to harness data, automate processes, and deliver customized solutions is driving the industry’s shift towards a more efficient and customer-centric model. As the adoption of insurtech continues to grow, it is poised to redefine the traditional insurance paradigms, making insurance more accessible, affordable, and responsive to the evolving needs of consumers.

Key Innovations in Insurtech

The insurance industry is undergoing a significant transformation driven by cutting-edge technological advancements. One of the most notable innovations is in underwriting. Automated underwriting algorithms are revolutionizing this critical process by leveraging artificial intelligence (AI) and big data analytics. These algorithms can rapidly analyze vast amounts of data to assess risk more accurately and efficiently than traditional methods. This not only speeds up the underwriting process but also enhances the precision of risk evaluation, leading to more competitive and personalized insurance products.

Another area where insurtech is making a substantial impact is claims processing. AI-driven claims adjustment is streamlining the traditionally cumbersome and time-consuming claims process. Through the use of AI, insurers can quickly review and validate claims, detect fraudulent activities, and even provide instant payouts for straightforward cases. This automation reduces the administrative burden on insurers and significantly improves the customer experience by shortening the time it takes to settle claims.

Customer service within the insurance sector is also benefiting from technological advancements. Chatbots and virtual assistants powered by AI are becoming increasingly prevalent, offering 24/7 customer support and immediate responses to inquiries. These tools enhance customer satisfaction by providing timely and accurate information, guiding users through the claims process, and offering personalized policy recommendations based on individual needs and preferences.

Risk assessment is another critical area being transformed by insurtech innovations. The use of big data analytics allows insurers to gather and analyze data from diverse sources, including social media, wearable devices, and Internet of Things (IoT) sensors. This comprehensive data collection provides insurers with deeper insights into individual behaviors and potential risks, enabling more precise pricing, targeted marketing, and proactive risk management strategies.

Overall, the integration of these technological innovations in underwriting, claims processing, customer service, and risk assessment is leading to enhanced operational efficiency, improved accuracy, and higher levels of customer satisfaction. The insurtech revolution is not only modernizing traditional insurance practices but also paving the way for a more responsive and customer-centric industry.

The Benefits and Challenges of Insurtech

Insurtech, a portmanteau of “insurance” and “technology,” offers significant benefits to both insurers and policyholders. One of the primary advantages is enhanced operational efficiency. With automation and advanced data analytics, insurers can streamline their processes, reducing the time and resources required for underwriting, claims processing, and customer service. This increased efficiency often translates to cost savings, which can be passed on to policyholders in the form of lower premiums.

Another notable benefit is improved risk management. Insurtech leverages big data, machine learning, and predictive analytics to assess risk more accurately. This enables insurers to offer more personalized policies and proactive risk mitigation strategies. Consequently, policyholders benefit from more tailored and often more affordable coverage options. Additionally, the customer experience is vastly improved through digital platforms that provide instant access to policy information, easy claims filing, and real-time customer support.

However, the implementation of insurtech solutions is not without its challenges. Cybersecurity threats are a significant concern, as the increased reliance on digital platforms and data makes insurers prime targets for cyberattacks. Data privacy is another critical issue. Insurers must ensure that the vast amounts of sensitive customer data they collect are securely stored and compliantly managed, adhering to regulations such as GDPR and CCPA.

Regulatory compliance itself poses another challenge. The rapidly evolving nature of technology can outpace existing regulations, leaving insurers in a complex and often unclear legal landscape. Additionally, the integration of insurtech solutions can disrupt traditional insurance models, potentially leading to resistance from stakeholders accustomed to conventional methods.

To navigate these challenges, companies should invest in robust cybersecurity measures and data protection protocols. Partnering with regulatory experts for compliance and fostering a culture of innovation can also facilitate smoother transitions. By addressing these hurdles, insurers can fully capitalize on the transformative potential of insurtech, ultimately benefiting all parties involved.

The Future of Insurtech

The trajectory of insurtech is poised to revolutionize the insurance industry, steering it toward a more data-driven, customer-centric future. Key emerging trends, such as predictive analytics, telematics, and peer-to-peer insurance models, are at the forefront of this transformation. Predictive analytics, for instance, leverages vast amounts of data to forecast risks and customer behaviors more accurately, enabling insurers to offer personalized policies and improve risk management strategies.

Telematics, particularly in auto insurance, is another game-changer. By using devices that monitor driving habits, insurers can provide usage-based insurance, rewarding safe driving with lower premiums. This not only benefits customers but also aligns with broader goals of road safety and environmental sustainability. Additionally, the adoption of telematics can lead to more accurate claims processing and fraud detection, further enhancing the efficiency of insurance operations.

Peer-to-peer (P2P) insurance models represent a shift towards community-based risk sharing. These models leverage social networks to pool resources for coverage, often resulting in lower costs and increased transparency. By fostering a sense of community and shared responsibility, P2P insurance can enhance customer trust and loyalty, challenging traditional insurance paradigms.

As insurtech continues to evolve, it is likely to drive the emergence of new business models and partnerships. Insurers may increasingly collaborate with technology firms, data analytics companies, and other stakeholders to remain competitive. Such partnerships can lead to the development of innovative products and services that cater to the changing needs of customers.

For insurers aiming to embrace these technologies, it is crucial to prioritize ethical standards and customer trust. Implementing robust data privacy measures, ensuring transparency in how data is used, and maintaining clear communication with customers are essential steps. By doing so, insurers can harness the benefits of insurtech while fostering a relationship of trust and reliability with their clientele.