Introduction to AI in Treasury Management

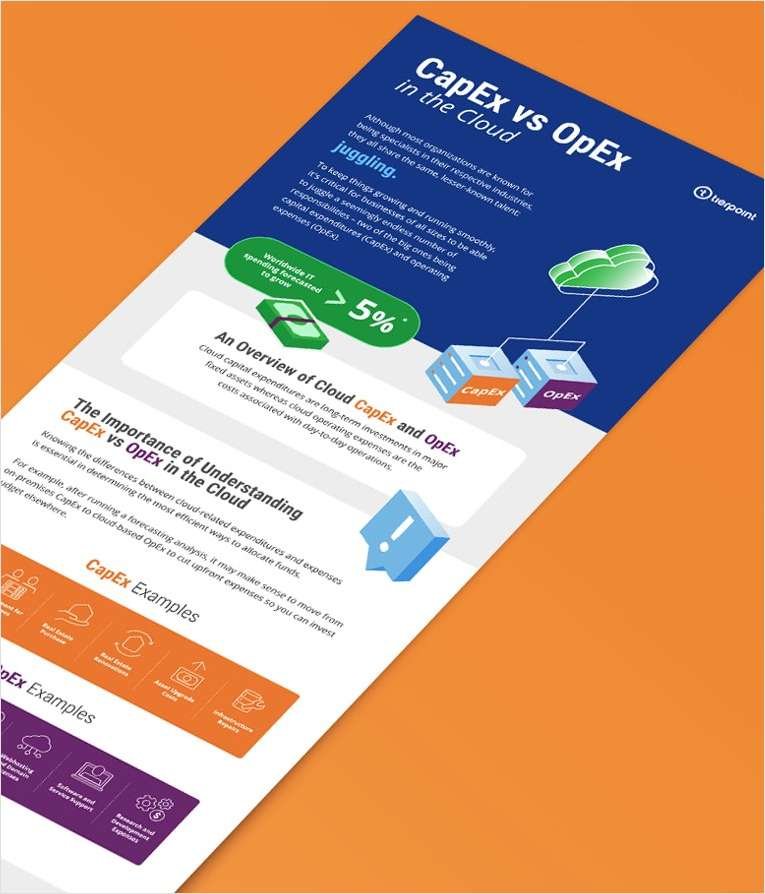

Artificial intelligence (AI) is revolutionizing various industries, and treasury management is no exception. Treasury management involves overseeing an organization’s holdings, including cash flow, investments, and risk management. In recent years, AI technologies such as machine learning, natural language processing, and predictive analytics have been increasingly integrated into treasury management processes, promising significant optimizations.

Traditional treasury management faces several challenges, notably in cash flow forecasting, risk management, and liquidity planning. Accurate cash flow forecasting is vital for maintaining liquidity and ensuring that an organization can meet its financial obligations. However, these forecasts are often fraught with inaccuracies due to the complex interplay of multiple variables. Risk management, another crucial aspect, involves identifying, assessing, and prioritizing risks followed by coordinated efforts to mitigate or manage them. Similarly, liquidity planning strives to ensure that sufficient cash is available to meet short-term needs without compromising long-term financial stability.

AI aims to address these inherent challenges by offering advanced tools and methodologies. Machine learning algorithms can analyze vast datasets to identify patterns and trends that are not immediately obvious, leading to more accurate cash flow forecasts. Predictive analytics leverages historical data and statistical algorithms to predict future events, enabling treasurers to make better-informed decisions regarding liquidity and risk management. Natural language processing (NLP) facilitates the processing and analysis of unstructured data from various sources, such as market reports and news articles, providing deeper insights into potential market risks and opportunities.

By integrating these AI technologies, treasury management can become more efficient and strategic. Automation of routine tasks enables treasury professionals to focus on more critical, high-level decision-making activities. Moreover, real-time analytics provide an up-to-the-minute understanding of financial positions, allowing for agile responses to market changes. This combination of enhanced analytical capabilities and workflow automation sets a new standard in the field of treasury management, maximizing both operational efficiency and strategic planning potential.

Enhancing Cash Flow Forecasting with AI

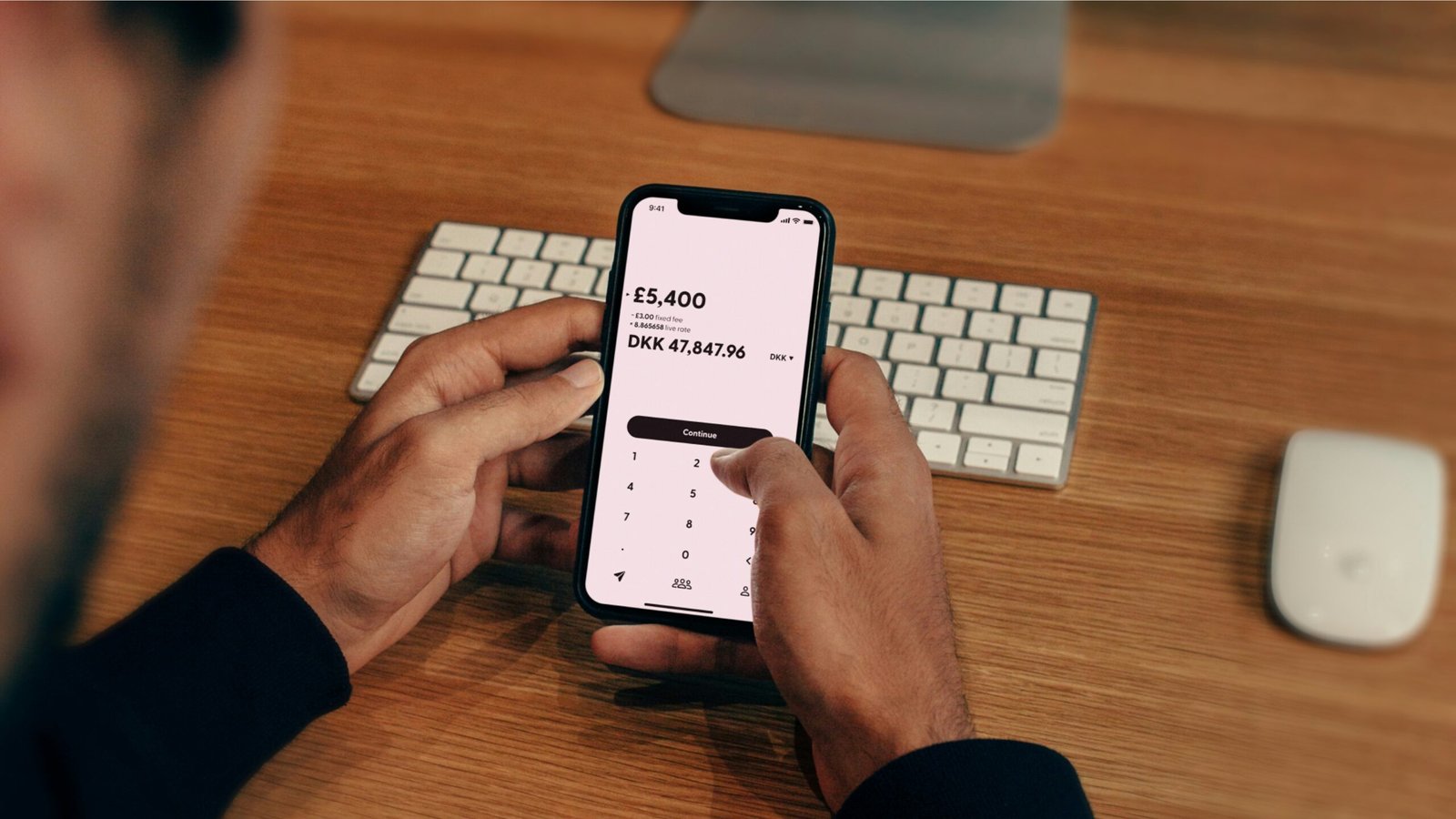

Artificial Intelligence (AI) has revolutionized many aspects of financial management, and cash flow forecasting is no exception. Traditional forecasting methods often rely on static algorithms and historical data that might not provide the needed accuracy in a rapidly changing economic landscape. AI-powered tools, however, enhance cash flow forecasting by leveraging vast amounts of historical and real-time financial data, along with sophisticated machine learning algorithms, to predict future cash flows with unprecedented accuracy.

The primary advantage of using AI for cash flow forecasting is the increase in precision. AI algorithms can process and analyze large datasets much faster and more accurately than a human analyst. This ability to handle complex and voluminous data allows AI tools to better account for variables such as economic shifts, seasonality, and market trends that traditional methods might overlook. This results in more reliable and detailed cash flow forecasts, enabling businesses to make more informed financial decisions.

Additionally, AI-powered cash flow forecasting can significantly speed up the processing time. While traditional methods might take days or weeks to compile and analyze data, AI systems can generate forecasts in real-time. This immediacy allows for more agile financial planning and the ability to quickly respond to any changes in the market or internal business conditions.

AI tools are also capable of continuous learning and improvement. They can adapt to new patterns in financial data and refine their forecasting models over time, which is particularly beneficial in an ever-evolving economic environment.

Several real-world examples demonstrate the success of AI in cash flow forecasting. For instance, a multinational corporation was able to reduce its forecasting error margin from 20% to just 2% by implementing an AI-driven system. Another company reported a 30% improvement in the accuracy of its cash flow predictions, which allowed for better resource allocation and strategic planning.

Incorporating AI into cash flow forecasting not only enhances accuracy and efficiency but also provides businesses with a strategic advantage in managing their financial health under various economic conditions.

AI for Risk Management and Fraud Detection

Artificial Intelligence (AI) is taking center stage in revolutionizing risk management and fraud detection within treasury operations. In an environment characterized by constant fluctuation, the primary objective of treasury managers is to monitor and mitigate various forms of risk including credit risk, market risk, and operational risk. AI algorithms, with their ability to process large datasets and identify subtle patterns, have become invaluable tools in these endeavors.

Credit risk, which pertains to the potential default of counterparties, can be preemptively managed through AI’s predictive analytics. By analyzing historical data and current market conditions, AI systems can forecast the likelihood of default, allowing treasury managers to make informed decisions before risks materialize. Similarly, market risk, associated with fluctuations in market prices like exchange rates, interest rates, and commodity prices, can be effectively mitigated. AI models can simulate various market scenarios and predict potential impacts on the treasury’s holdings, thus enabling strategies to hedge against adverse movements.

Operational risk involving internal process failures or human errors can also be reduced with AI’s real-time monitoring capabilities. AI systems can continuously track and analyze transactional data to identify anomalies that may indicate process inefficiencies or potential threats. This proactive risk management approach minimizes the likelihood of significant financial loss or operational disruption.

Fraud detection is another critical area where AI excels. Traditional methods of fraud detection often fail to keep up with the sophisticated techniques employed by fraudsters. AI tools, however, are capable of real-time data analysis and pattern recognition, which facilitates the rapid detection of fraudulent activities. For instance, machine learning models can learn the normal transaction behaviors of users and flag deviations that may suggest unauthorized activities. Neural networks, a form of AI, can also identify complex patterns that traditional statistical methods might miss, thereby increasing the accuracy and speed of fraud detection.

Examples of AI applications in fraud detection include the use of anomaly detection systems in monitoring payment transactions. These systems can identify irregular behaviors such as unusually large fund transfers or deviations from routine transaction patterns, prompting immediate investigation. Additionally, AI-driven security systems can screen for phishing attempts and other cyber threats, enhancing the overall security of the treasury operations.

By leveraging AI in risk management and fraud detection, treasury managers can achieve heightened vigilance, thereby safeguarding financial assets and ensuring organizational stability.

Future Trends and Implications of AI in Treasury Management

The trajectory of AI in treasury management suggests a landscape where technology continually redefines operational paradigms. One prominent future trend involves the integration of blockchain technology, which offers robust security features for financial transactions. Blockchain’s distributed ledger system ensures transparency and immutability, minimizing the risk of fraud and significantly enhancing trust in financial operations. As blockchain becomes more prevalent, its synergy with AI could bolster secure, efficient, and rapid processing of financial transactions.

Enhanced AI-driven decision-making tools are another promising advancement on the horizon. These tools will likely evolve to provide more sophisticated data analytics, enabling treasury departments to make predictive and highly accurate financial decisions. The convergence of AI and advanced analytics can lead to superior forecasting models that adapt in real-time, thereby optimizing cash flow management and investment strategies. AI’s capability to analyze vast amounts of data swiftly will empower treasury professionals to identify patterns and trends that would be impossible to detect manually.

The potential for fully autonomous treasury functions is a transformative trend worth noting. As AI systems advance, they may ultimately undertake end-to-end treasury operations, from liquidity management to risk assessment, with minimal human intervention. This level of autonomy could drive unprecedented efficiency, albeit necessitating robust oversight mechanisms to manage potential risks associated with autonomous decision-making.

Broader implications for treasury personnel are multifaceted. While AI can augment treasury functions, the human element remains indispensable, particularly in areas requiring strategic judgment and nuanced decision-making. Ethical considerations arise as well, as the deployment of AI necessitates adherence to ethical standards to prevent biases and ensure fair practices. Additionally, data privacy remains a paramount concern, given the sensitive nature of financial information AI systems handle. Rigorous data protection protocols will be essential to safeguard against breaches and unauthorized access.

Finally, the rapid evolution of AI underscores the need for continuous learning and adaptation within the workforce. Treasury professionals must actively engage in upskilling to harness AI effectively, ensuring they remain relevant and capable in a technology-driven financial landscape. By embracing both technological advancements and the imperative of ongoing education, the treasury function can navigate the complexities of an AI-integrated future with confidence and resilience.