Credit scoring is a crucial element of the financial industry, serving as a foundational tool for assessing the creditworthiness of individuals and businesses. Traditionally, credit scoring methods have relied on standardized metrics such as FICO scores, which are calculated based on an individual’s credit history, amount of debt, length of credit history, types of credit in use, and recent credit inquiries. These scores are pivotal for lenders when evaluating the risks associated with lending money or issuing credit.

FICO scores, devised by the Fair Isaac Corporation, provide a numerical representation of a person’s credit reliability, assisting banks and other financial institutions in making informed lending decisions. While these traditional credit scoring models have been effective, they are not without limitations. They often fail to account for nuances in an individual’s financial behaviour and can sometimes be rigid, reflecting past behaviors without providing real-time insights.

Enter Artificial Intelligence (AI), an advanced technology poised to revolutionize various sectors, including credit scoring. AI encompasses a range of technologies designed to simulate human intelligence, including machine learning, natural language processing, and neural networks. Unlike traditional computational methods, AI can process vast amounts of data at unparalleled speed and precision, enabling it to identify patterns and correlations that might be invisible to human analysts or traditional algorithms.

The integration of AI into credit scoring and financial assessment marks a significant shift towards more dynamic and nuanced credit evaluation processes. In the realm of fintech, AI is being harnessed to enhance the accuracy and fairness of credit assessments. By analyzing a broader spectrum of data points—including non-traditional indicators such as digital footprint, transactional behaviors, and more—AI models can offer a more comprehensive view of an individual’s creditworthiness.

Additionally, AI’s predictive capabilities allow for real-time scoring adjustments, providing lenders with up-to-date risk assessments. This is a pivotal advantage over conventional methods, which may rely heavily on static historical data. The growing adoption of AI in credit scoring reflects a broader trend of digital transformation across the financial sector, signaling a future where lending decisions are driven by more sophisticated, data-driven insights.

Artificial Intelligence (AI) has revolutionized various industries, and credit scoring is no exception. One of the primary advantages of AI-driven credit scoring is its enhanced accuracy and predictive capabilities. Traditional credit scoring methods often rely on a limited set of financial data, such as credit history and income. In contrast, AI leverages vast and diverse data sets, which include non-traditional sources like social media behavior, online transactions, and even utility payments. By analyzing these comprehensive data points, AI can create a more detailed and accurate credit profile.

This expanded data analysis results in more inclusive credit assessments. For individuals who may have limited or no traditional credit history, such as young adults or those recently relocated, AI can utilize alternative data to establish their creditworthiness. This inclusivity opens avenues for more people to gain access to credit, which can significantly impact their financial well-being.

Moreover, AI possesses the remarkable ability to reduce bias and human error in credit scoring. Human judgment is inherently prone to biases, whether conscious or unconscious. AI algorithms, when properly designed and trained, can minimize these biases by making decisions purely based on data. Additionally, the automated nature of AI systems ensures consistency and accuracy in credit assessments, further mitigating the risks of human error.

Another substantial benefit is the speed at which AI can process credit applications. Traditional credit approval processes can be time-consuming and cumbersome, involving several manual steps. AI-driven systems can rapidly analyze and process applications, significantly reducing the time required for credit approval. This efficiency not only benefits lenders by streamlining their operations but also enhances the customer experience by providing quicker access to credit.

Furthermore, AI enables personalized lending solutions. By deeply understanding an individual’s unique financial behaviors and needs, AI can tailor lending products that best suit their circumstances. This personalization can lead to more favorable loan terms and improved satisfaction among borrowers.

Real-world examples underscore the effectiveness of AI in credit scoring. For instance, Upstart, an AI-driven lending platform, has demonstrated that its AI models can approve more loans with lower loss rates compared to traditional methods. Similarly, major financial institutions like JPMorgan Chase have integrated AI into their credit risk assessments, resulting in more accurate and faster decision-making processes.

Challenges and Concerns with AI in Credit Scoring

Implementing AI in credit scoring brings forth several significant challenges and ethical concerns that warrant close attention. Among the most pressing issues is the potential for algorithmic bias. AI systems are trained on historical data, which may reflect existing socioeconomic disparities. Consequently, there is a risk that these systems will inadvertently perpetuate, or even exacerbate, current inequalities. Such biases can result in unfair credit scoring decisions that disproportionately impact marginalized groups.

Another critical concern is the matter of data privacy and security. AI credit scoring systems require extensive access to sensitive financial information to function effectively. Ensuring the safekeeping of this data is paramount, as breaches can result in significant financial and personal harm to consumers. Businesses are tasked with implementing rigorous cybersecurity measures to protect against unauthorized access and leaks.

The regulatory landscape also poses formidable challenges. Current laws and regulations may lag behind the rapid technological progress in AI, often leaving gaps in oversight. This misalignment can result in insufficient consumer protections and regulatory uncertainties for financial institutions. Policymakers are faced with the task of developing frameworks that can adapt to and address the evolving nature of AI technology.

Additionally, there is potential resistance from stakeholders within traditional financial institutions and from the general public. Many within established financial systems may view AI-driven credit scoring with skepticism, concerned that it could disrupt conventional methodologies and established roles. Meanwhile, consumers may be wary of the opacity of AI processes and question the fairness and accuracy of AI-generated credit decisions.

Addressing these issues requires a balanced approach that emphasizes transparency and accountability in AI algorithms. It’s essential for financial institutions to adopt ethical AI practices, continuously monitor for biases, and engage in open communication with stakeholders. By doing so, they can foster greater trust and acceptance of AI in credit scoring, ultimately leading to fairer and more efficient financial systems.

The Future of AI in Credit Scoring

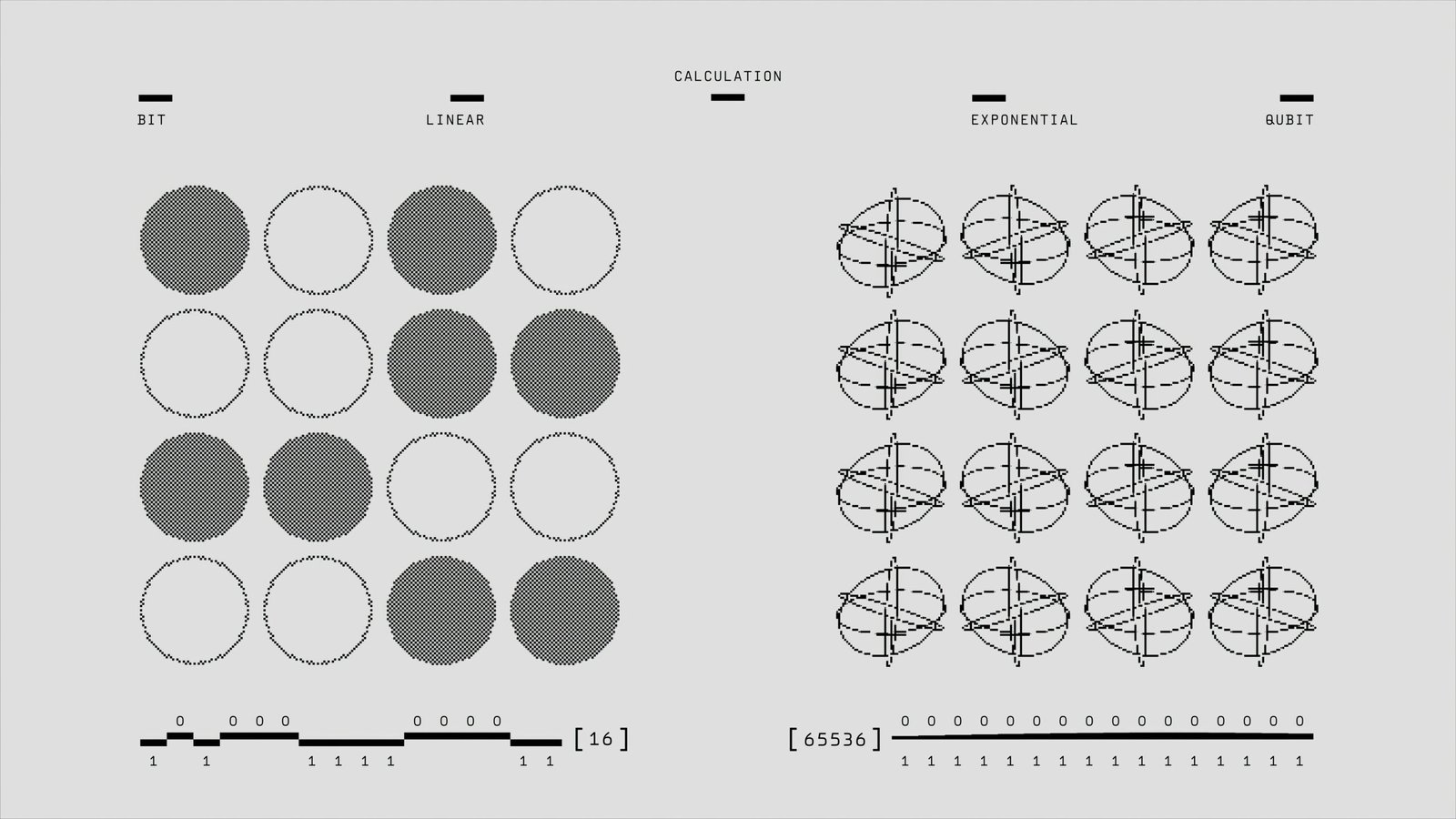

As the pace of technological progress accelerates, the future of AI in credit scoring appears increasingly promising. With continual advancements in machine learning, AI-powered credit scoring systems are poised to become more accurate, efficient, and inclusive. By analyzing vast amounts of data, these sophisticated models can discern patterns and predict creditworthiness with unparalleled precision. Emerging technologies such as blockchain further enhance the reliability and transparency of these AI-driven systems, creating a more secure and trustworthy credit assessment process.

Blockchain technology offers a decentralized and immutable ledger, which can be integrated with AI to provide greater transparency in credit scoring. This integration ensures that credit scoring models are not only accurate but also resistant to tampering, thereby increasing trust among consumers and financial institutions alike. Additionally, as blockchain becomes more prevalent, it could lead to the development of innovative credit scoring paradigms that are less reliant on traditional financial histories.

Regulatory changes are expected to play a significant role in shaping the future of AI in credit scoring. Policymakers are increasingly recognizing the potential of AI to democratize access to credit and foster financial inclusion. By implementing regulations that ensure ethical usage while promoting innovation, governments can facilitate the wider adoption of AI-driven credit systems. This legal framework will likely emphasize transparency, accountability, and fairness, aiming to protect consumers’ interests without stifling technological advancement.

Looking ahead, AI-driven credit scoring systems hold the potential to democratize access to credit, particularly for underserved populations. By using alternative data sources and advanced analytics, these systems can provide more comprehensive assessments of individuals’ creditworthiness, thereby extending credit opportunities to those previously overlooked by traditional models. This inclusivity can drive economic growth and empower individuals through enhanced financial access.

Stakeholders in the financial ecosystem must prepare for these advancements by investing in AI technologies and developing robust data governance frameworks. Additionally, fostering collaborations between tech companies, financial institutions, and regulatory bodies will be crucial in navigating the evolving landscape of AI in credit scoring. By staying adaptable and proactive, stakeholders can harness the full potential of these innovations to create a more inclusive and efficient credit ecosystem.