Introduction to Blockchain Technology

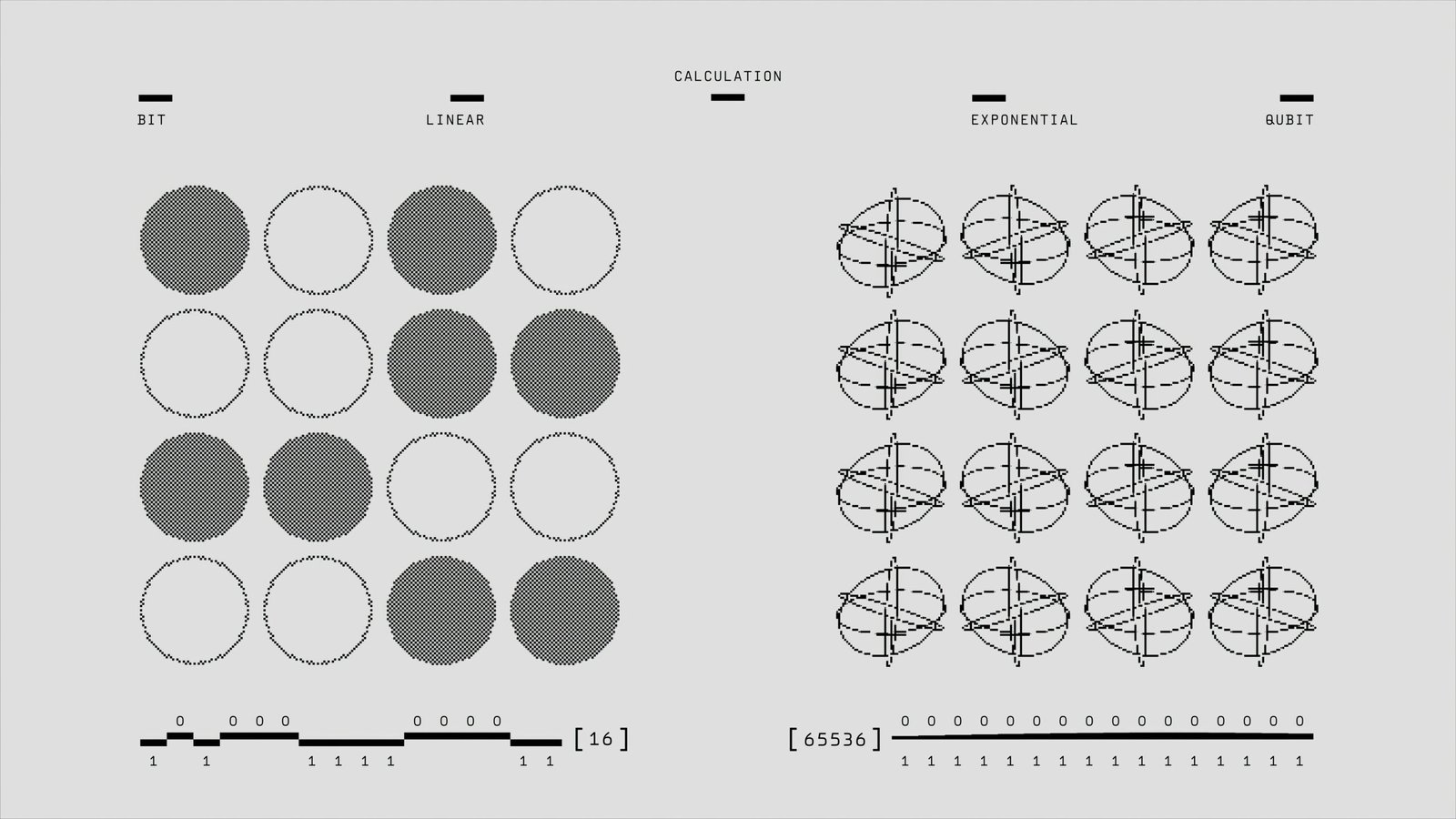

Blockchain technology, often described simply as a digital ledger, is a groundbreaking innovation that has revolutionized the way data is recorded and transferred. At its core, blockchain operates on principles of decentralization, immutability, and transparency, which collectively ensure that once data is recorded, it cannot be altered retroactively. This unique characteristic of blockchain is driven by its structure, where transactions are compiled into blocks and linked together in a chain, forming a distributed ledger technology (DLT).

Decentralization is a pivotal aspect of blockchain, distinguishing it from traditional centralized databases. Instead of a single entity having control, a network of nodes, or computers, validates and records transactions. This not only enhances security but also mitigates risks associated with central points of failure. Immutability ensures that after transactions are recorded in a block, they can’t be changed or deleted, preserving the integrity and trustworthiness of the data. Transparency, another crucial principle, allows all network participants to view transaction history, thereby fostering an environment of accountability and trust.

The concept of consensus mechanisms is integral to the functioning of blockchain networks. These mechanisms, such as Proof of Work (PoW) or Proof of Stake (PoS), enable nodes to agree on the validity of transactions, ensuring that only legitimate transactions are added to the blockchain. This consensus is achieved without the need for a central authority, further underlining the decentralized nature of blockchain.

The history of blockchain traces back to 2008, when it was conceptualized by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Blockchain’s first application was in Bitcoin, the pioneering cryptocurrency that introduced the world to the potential of decentralized digital currencies. Since then, blockchain technology has evolved beyond cryptocurrencies, finding applications across various sectors, including finance, supply chain management, healthcare, and more. Its ability to provide secure, transparent, and efficient transaction processes continues to drive innovation and adoption in numerous industries.

Blockchain Applications in Financial Services

Blockchain technology has significantly transformed the financial services industry, offering innovative solutions across various domains such as cryptocurrency transactions, smart contracts, decentralized finance (DeFi), and identity verification. By leveraging blockchain’s decentralized and immutable ledger, financial institutions can enhance transparency, security, and efficiency in their operations.

One of the most prominent applications of blockchain in financial services is cryptocurrency transactions. Cryptocurrencies like Bitcoin and Ethereum utilize blockchain to enable peer-to-peer transactions without the need for intermediaries such as banks. This not only reduces transaction costs but also increases the speed and security of cross-border payments. Companies like Coinbase and Binance have successfully implemented blockchain to offer secure and efficient cryptocurrency trading platforms.

Smart contracts are another critical application of blockchain technology in financial services. These self-executing contracts with the terms of the agreement directly written into code eliminate the need for intermediaries and reduce the risk of fraud. For instance, Ethereum’s blockchain allows developers to create decentralized applications (dApps) that automate various financial processes. A notable example is Slock.it, which uses Ethereum’s smart contracts to facilitate secure and automated rental agreements.

Decentralized Finance, or DeFi, represents a revolutionary shift in the financial sector by enabling the creation of financial products and services that operate without centralized control. DeFi platforms such as MakerDAO and Uniswap utilize blockchain to offer lending, borrowing, and trading services without traditional financial institutions. This democratizes access to financial services, allowing users to engage in financial activities through decentralized networks.

Blockchain-based identity verification is also gaining traction within the financial services industry. Traditional identity verification processes are often cumbersome and prone to security breaches. Blockchain offers a more secure and efficient alternative by storing identity data on a decentralized ledger. Companies like Civic and uPort are pioneering blockchain-based identity solutions, providing individuals with greater control over their personal information while ensuring robust security for financial institutions.

Real-world case studies further illustrate the successful implementation of blockchain in financial services. For example, Santander, a global banking giant, has launched a blockchain-based platform called One Pay FX, which enables fast and transparent international payments. Similarly, AXA, a leading insurance company, has developed Fizzy, a blockchain-based flight delay insurance product that automatically compensates customers using smart contracts.

In summary, blockchain technology is revolutionizing financial services by providing innovative solutions that enhance security, transparency, and efficiency. From cryptocurrency transactions and smart contracts to DeFi and identity verification, blockchain’s applications are diverse and impactful, driving the industry towards a more decentralized and trustworthy future.

Benefits and Challenges of Blockchain in Fintech

Blockchain technology offers a transformative potential for the financial services sector, bringing a multitude of advantages that could significantly enhance operational efficiency and security. One of its foremost benefits is increased security. Blockchain’s decentralized nature ensures that data is distributed across multiple nodes, making it inherently less vulnerable to hacking and unauthorized alterations. This fortification against cyber threats is a noteworthy improvement over traditional centralized systems.

Improved transparency is another major advantage. Each transaction added to the blockchain is timestamped and linked to the previous transaction, creating an immutable ledger that can be audited in real-time. This enhanced visibility can reduce discrepancies and build trust among stakeholders.

Furthermore, blockchain technology can reduce fraud by providing a clear, tamper-proof record of transactions. This can be particularly beneficial in areas like anti-money laundering (AML) and know-your-customer (KYC) processes, where authenticity and traceability are critical.

Another significant benefit is the potential for lower transaction costs. By eliminating intermediaries and automating processes through smart contracts, blockchain can streamline operations, leading to reduced fees and faster processing times. This efficiency can be particularly advantageous for cross-border transactions, which are often plagued by high costs and delays.

Despite these benefits, the integration of blockchain in fintech is not without challenges. Regulatory hurdles represent a significant obstacle. The evolving nature of blockchain technology means that regulatory frameworks are often playing catch-up, creating uncertainty for financial institutions. Additionally, there are scalability issues to consider. As the number of transactions increases, so does the strain on the network, potentially leading to slower transaction times and higher costs.

The challenge of integration with existing systems cannot be overlooked. Financial institutions have long-established infrastructures, and the integration of blockchain technology into these systems can be complex and costly. Moreover, achieving widespread industry adoption is essential for blockchain’s success in fintech. Without a critical mass of participants, the full benefits of a decentralized network cannot be realized.

In comparison to traditional systems, blockchain offers promising improvements in security, transparency, and efficiency. However, it is crucial to recognize and address the limitations and challenges that come with its adoption. A balanced view of both the promise and the hurdles is essential for a realistic understanding of blockchain’s potential in transforming financial services.

The Future of Blockchain in Financial Services

The future of blockchain in the financial services industry promises to be transformative, driven by continuous technological advancements and a growing interest from institutional investors. As regulatory frameworks evolve to better accommodate blockchain technology, its adoption is expected to accelerate, offering more secure, efficient, and transparent financial solutions. One of the most significant potential impacts of blockchain in fintech lies in cross-border payments. Blockchain can facilitate near-instantaneous transactions with reduced fees compared to traditional banking systems, making it an attractive option for both individuals and businesses engaged in international trade.

In the realm of lending, blockchain can offer greater transparency and security, reducing the risk of fraud and enabling more efficient credit scoring processes. By leveraging blockchain’s immutable ledger, lenders can verify borrowers’ credit histories with unprecedented accuracy, leading to faster loan approvals and potentially lower interest rates. Moreover, blockchain-enabled smart contracts can automate the enforcement of loan terms, ensuring compliance and reducing administrative overhead.

Digital identity management is another area where blockchain is poised to make a significant impact. Blockchain can provide a decentralized and secure way to verify identities, reducing the risk of identity theft and streamlining KYC (Know Your Customer) processes. This can enhance user experience and compliance, particularly in sectors like banking and insurance, where accurate identity verification is crucial.

Furthermore, the integration of blockchain with other emerging technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) could lead to more sophisticated financial solutions. For instance, AI algorithms can analyze vast amounts of blockchain-stored data to generate insights and predictions, while IoT devices can facilitate real-time data collection for seamless transactions and automated decision-making. This convergence of technologies holds the potential to revolutionize financial services, paving the way for more innovative, efficient, and secure financial ecosystems.

As blockchain continues to evolve, its role in the fintech industry will expand, driving further disruption and enhancement across various financial sectors. The ongoing collaboration between technology providers, financial institutions, and regulators will be crucial in shaping this future, ensuring that blockchain’s full potential is realized in a way that benefits all stakeholders.