Introduction to Central Bank Digital Currencies

Central Bank Digital Currencies (CBDCs) represent a modern adaptation of traditional fiat currencies, tailored for the digital age. Unlike cryptocurrencies, which are typically decentralized and operate on blockchain technology, CBDCs are issued and regulated by central banks. They serve as a digital counterpart to physical cash, maintaining intrinsic value backed by national governments. This foundational distinction underscores the primary features of CBDCs: they are centralized, state-issued, and designed to be legal tender.

CBDCs differentiate themselves from traditional fiat currencies by their form and functionality. While fiat money exists primarily in physical notes and coins, CBDCs are entirely digital. This digital nature allows for greater efficiency in transactions and record-keeping, potentially reducing the costs associated with printing, distributing, and managing physical currency. Furthermore, CBDCs can take on various forms, primarily categorized into retail and wholesale. Retail CBDCs are intended for use by the general public in everyday transactions, much like cash. In contrast, wholesale CBDCs are designed for use by financial institutions and facilitate large-scale interbank transactions and settlement processes.

The exploration and development of CBDCs by central banks are driven by several compelling factors. One significant motivation is the potential to enhance financial inclusion. By providing a digital currency that can be accessed via smartphones, central banks aim to bring unbanked populations into the formal financial system. Additionally, CBDCs offer the promise of improving payment systems by making transactions faster, more secure, and more cost-effective. This capability is especially relevant in an era where digital transactions are becoming increasingly prevalent.

Finally, the advent of CBDCs ensures that central banks maintain monetary sovereignty in a rapidly evolving digital landscape. As digital currencies and payment methods proliferate, central banks recognize the need to adapt to maintain control over monetary policy and the stability of the financial system. By developing their own digital currencies, central banks can influence and regulate the digital economy, ensuring that it aligns with national and economic interests.

Historical Context and Early Developments

The concept of Central Bank Digital Currencies (CBDCs) is intricately tied to the broader history of digital finance and monetary evolution. Initially, the advent of digital banking and the proliferation of electronic payment systems set the stage for the conceptualization and eventual materialization of CBDCs. The shift from physical to digital forms of money began as early as the 1990s with the introduction of online banking, and later, the emergence of fintech innovations that revolutionized financial transactions.

Sweden’s e-krona and China’s digital yuan represent two pioneering efforts in the field of CBDCs. Sweden, a country already on the cusp of becoming a cashless society, initiated the e-krona project in response to dwindling cash usage and the need for a state-backed digital alternative. The Riksbank’s exploratory pilot projects aimed at assessing the feasibility and implications of a digital currency within a technologically advanced yet financially inclusive framework.

In contrast, China’s digital yuan, or Digital Currency Electronic Payment (DCEP), was driven by different motives. The People’s Bank of China (PBoC) embarked on the digital yuan project as part of a broader strategy to enhance payment efficiency, reduce fraud, and potentially challenge the dominance of the US dollar in international trade. The extensive pilot programs across various cities and sectors underscored China’s commitment and technological prowess in digital currency innovation.

Early developments in CBDCs were not without challenges. These included concerns over cybersecurity, the potential displacement of commercial banks, and the broader economic implications of such a shift. Critics also raised alarms regarding privacy and data security, emphasizing the need for robust legal and regulatory frameworks to govern digital currencies.

Despite these hurdles, the initial forays into CBDCs by Sweden, China, and other countries have provided invaluable insights and set critical precedents. These early developments have not only demonstrated the viability of digital currencies but also highlighted the transformative potential they hold for the future of global finance.

Technological and Regulatory Considerations

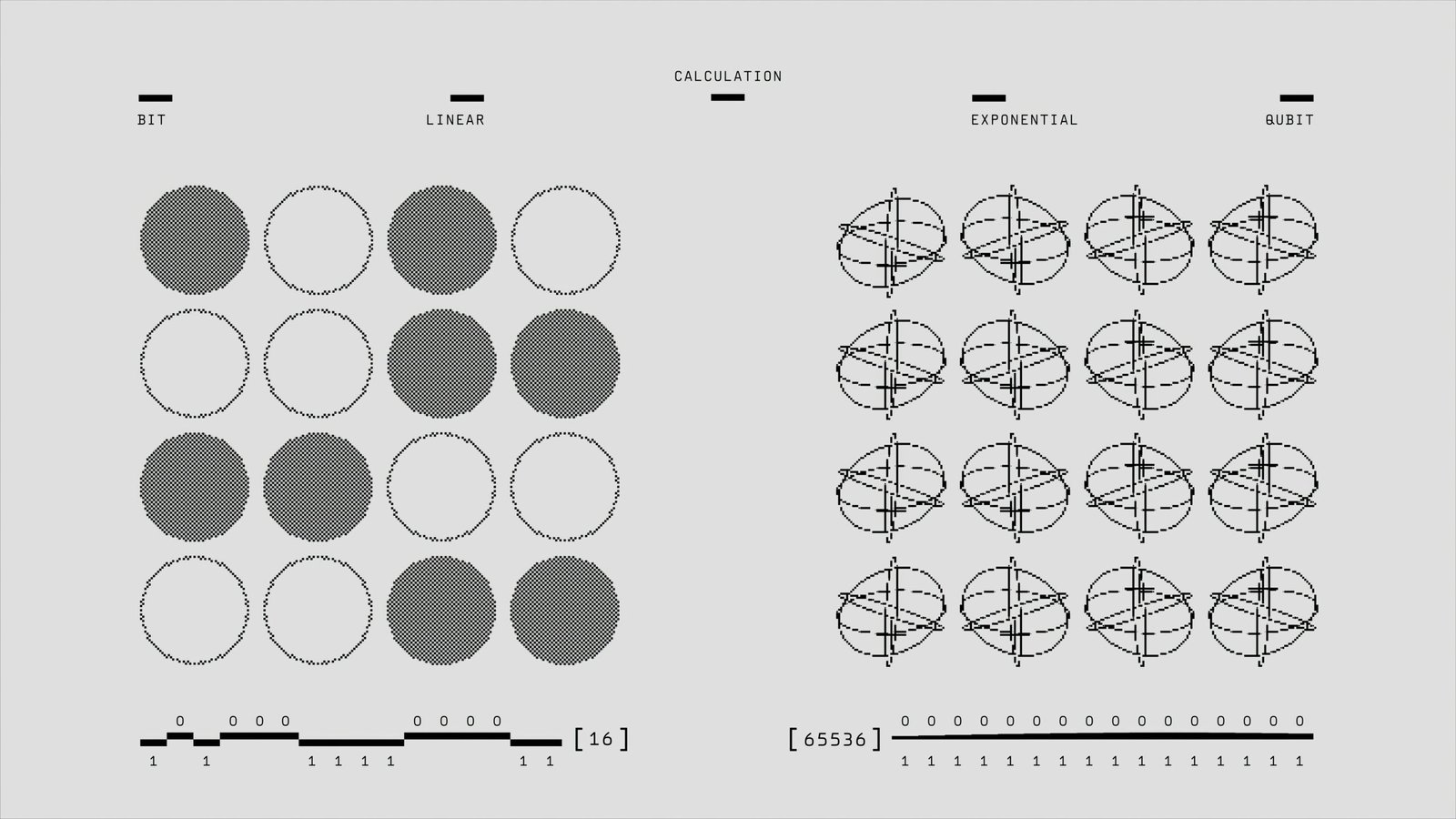

The development and implementation of Central Bank Digital Currencies (CBDCs) necessitate robust technological and regulatory frameworks. One of the primary technological considerations is the choice between blockchain and centralized databases. Blockchain technology offers decentralization, transparency, and enhanced security, making it an attractive option for many central banks. However, centralized databases can provide higher transaction speeds and greater control over monetary policy implementation, which are crucial factors for central banks to consider.

Security is another significant concern in the deployment of CBDCs. Ensuring the integrity and confidentiality of transactions is paramount to preventing cyber-attacks and fraud. Advanced encryption and multi-factor authentication are essential components of a secure CBDC system. Furthermore, the need for regular security audits and adherence to international cybersecurity standards cannot be overstated.

Privacy implications also play a critical role in the design of CBDCs. While blockchain can offer a degree of anonymity, it is often pseudonymous rather than fully anonymous. Central banks must strike a balance between ensuring user privacy and adhering to anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations. This balance is essential to gain public trust and ensure compliance with global standards.

Interoperability with existing financial systems is another crucial aspect. CBDCs must seamlessly integrate with current banking infrastructure, payment systems, and other financial technologies to ensure smooth transactions and widespread adoption. Interoperability will facilitate cross-border transactions and enhance the efficiency of global financial markets.

Regulatory Landscape

The regulatory landscape for CBDCs is complex and involves multiple stakeholders. International organizations such as the International Monetary Fund (IMF) and the Bank for International Settlements (BIS) play a pivotal role in setting global standards and guidelines for CBDCs. These organizations provide a framework that ensures consistency, security, and stability across different jurisdictions.

National regulatory bodies also have a significant role in shaping the CBDC landscape. They are responsible for drafting regulations that address issues such as consumer protection, data privacy, and financial stability. Coordination between international and national regulatory bodies is essential to creating a cohesive and effective regulatory environment for CBDCs.

In summary, the successful implementation of CBDCs hinges on addressing key technological challenges and establishing a comprehensive regulatory framework. By carefully considering these factors, central banks can develop digital currencies that are secure, efficient, and aligned with global standards.

Future Prospects and Global Impact

The future prospects of Central Bank Digital Currencies (CBDCs) are poised to redefine the economic landscape with significant global impact. The potential benefits of widespread CBDC adoption are numerous. One of the most prominent advantages is the increased efficiency in payments. By leveraging digital currency technology, transactions can be processed quickly and at a lower cost, thereby facilitating smoother and more reliable financial activities. This technological advancement is particularly beneficial for cross-border payments, which have historically been slow and expensive due to the involvement of multiple intermediaries.

Enhanced monetary policy tools are another critical benefit. CBDCs offer central banks a more direct mechanism to implement monetary policies. For example, during economic downturns, central banks could distribute money directly to citizens or businesses, bypassing traditional banking systems and thus ensuring that financial support reaches those in need more swiftly. This could potentially lead to more effective and timely economic interventions.

However, the adoption of CBDCs is not without risks. One significant concern is financial instability. The introduction of a new form of currency could lead to shifts in the traditional banking sector, potentially causing liquidity issues if a large number of citizens decide to convert their deposits into CBDCs. Furthermore, the reduced privacy associated with digital currencies poses another challenge. Unlike cash transactions, which offer anonymity, CBDC transactions could be traceable, raising concerns about surveillance and the protection of personal financial information.

Geopolitically, the development of CBDCs could alter the balance of economic power. Countries that swiftly adopt and effectively implement CBDCs may gain a competitive edge in global finance. China, for instance, has been at the forefront of CBDC development with its digital yuan, possibly positioning itself as a leader in this new era of digital finance. Conversely, nations that lag in CBDC adoption may find themselves at a disadvantage, potentially facing economic pressures as they struggle to keep pace with technological advancements.

In conclusion, the future of CBDCs holds both promise and challenges. As different countries navigate the complexities of CBDC implementation, the global financial system is likely to experience profound changes. The success of CBDCs will depend on careful consideration of the associated economic, social, and geopolitical implications, ensuring that the benefits outweigh the risks.